It’s important to understand how much your mortgage will cost. Remember that these costs are in addition to the amount you borrowed and can be almost as much as that amount.

If you borrow $285,000 at a 5 percent interest rate, you’ll pay back that $285,000 plus $266,000 in interest over thirty years, for a total of $551,000. And that interest is just one of the costs—there are others as well.

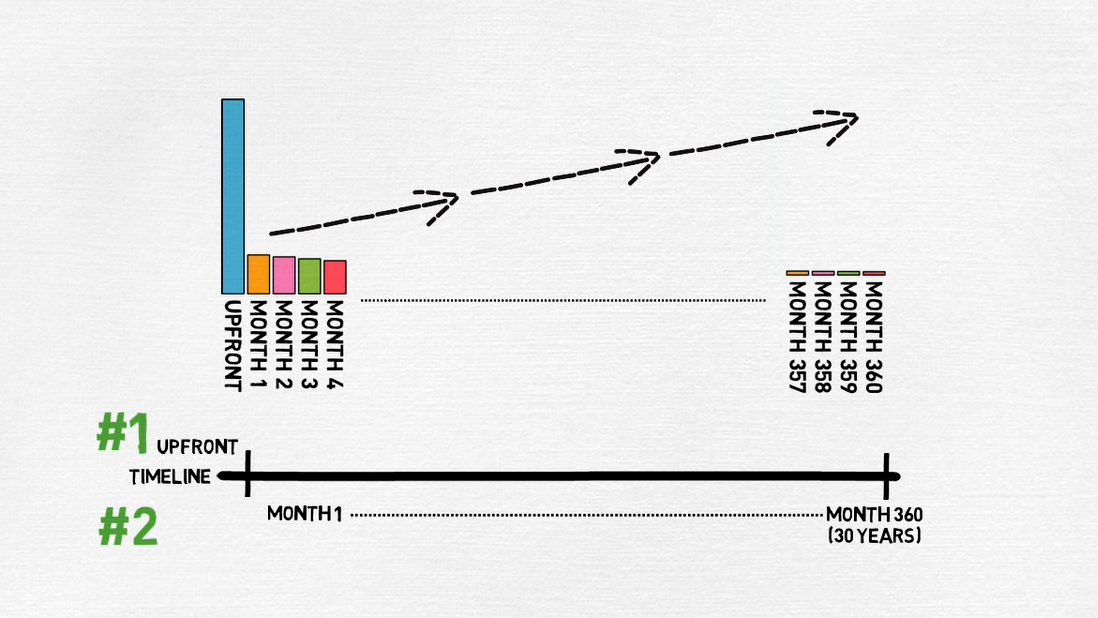

The cost of your mortgage can be separated into two broad categories: the first category includes things you’ll pay for up front in addition to your down payment, and the second category includes the things you’ll pay for every month for term of the mortgage.

It’s important to add upfront costs and monthly costs together when you are comparing options. This brings up an important question. How do you compare mortgage options? Once you apply for a mortgage, regulations require lenders to send you a loan estimate, which does a great job of outlining these costs.

Page 1 of the loan estimate shows the amount you pay monthly. Make sure you’re comfortable with this amount. Just because a lender approves you on their end for a monthly payment doesn’t mean that this amount is right for your individual situation. See if you feel comfortable with this number by including it in your budget.

You can use our tool, Bundle Budget, to help with this. As part of the up-front mortgage costs, lenders may charge you processing fees, underwriting fees, application fees, origination points, and/or discount points. Instead of worrying about the differences in these, just go by the total.

The second page of the loan estimate summarizes these costs in section A. This page will also show other closing costs you’ll pay to buy your home along with lender credits. Lender credits are amounts that decrease the upfront costs of your mortgage.

You’ll likely pay higher interest on a mortgage with lender credits than you would on a mortgage without lender credits. On page 3, the comparisons section is very important.

These are numbers that summarize the total cost of your mortgage. As the name suggests, this is the best way to compare one loan estimate with another loan estimate.

Annual percentage rate, or APR, combines up-front charges with monthly charges going forward and presents them as a rate. Some people find this difficult to understand. we don’t buy things in percentages in our daily lives. The cashier at the grocery store doesn’t give you a percentage when you check out. They give you a dollar amount.

That’s why, if you’re going to focus on one comparison, “in five years” is a good choice. This shows you the total amount you’ll pay over a five-year period, along with the amount of the mortgage balance you’ll have paid off.

When you receive mortgage bids from loan officers on Bundle, you’ll be able to compare both the APR and the “in 5 years” numbers side-by-side of each bid. Remember, you’re shopping for two main things: the home and the mortgage—and their prices can be similar.

In the next video, we’ll talk through the overall mortgage process.