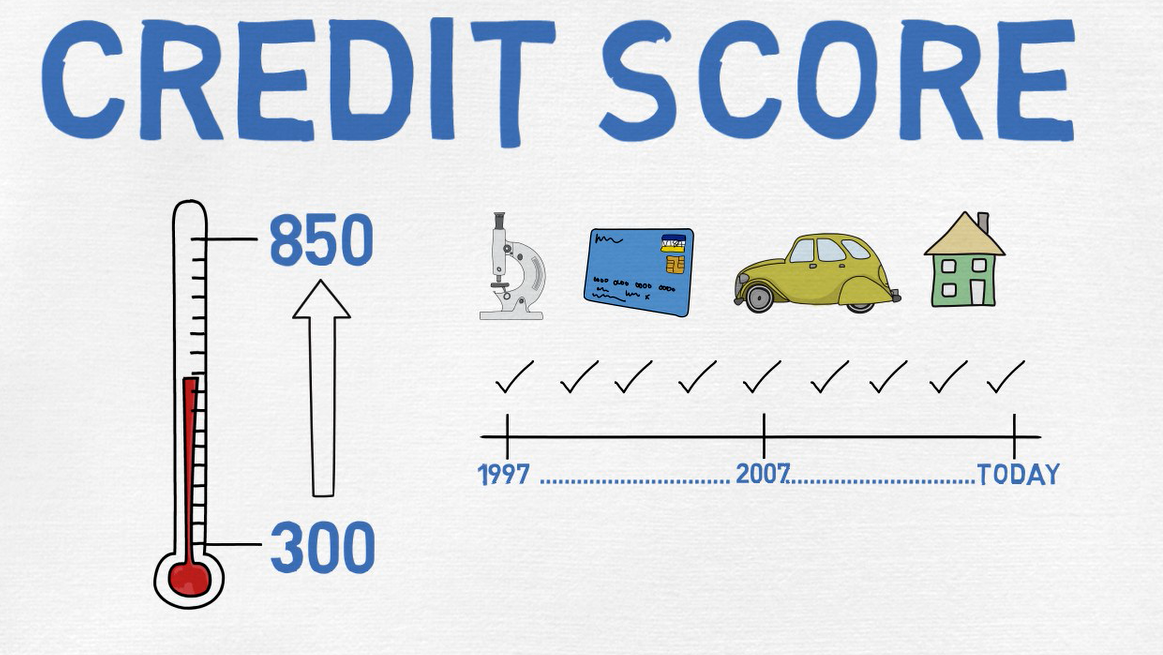

A credit score is a number between 300 and 850 that is based on your credit history. Now that you know how your down payment affects the cost of your mortgage, let’s talk through your credit score, which also impacts the cost of your mortgage.

This score gives banks an indication of how you’ve done, in the past, as far as paying back your loans, including student loans, credit card balances, auto loans, and mortgages.

If you’ve been late on a loan payment or missed one altogether, this may be reflected in your credit score. The score also considers your current loan balances. A high credit score—let’s say 790—is a signal to banks that, based on your credit history, you are more likely to pay back your mortgage than someone with a low credit score of, let’s say, 625.

A customer with a 790 credit score will have lower mortgage costs than a customer with a 625 score. In fact, some credit scores are so low that banks won’t approve the mortgage application at all.

In addition to your credit score, banks are going to look at your monthly loan obligations. Your credit report will show these and add these to your monthly mortgage payment.

Tip

Once they add these up, they will compare the total amount to your monthly income to determine if you can comfortably make your mortgage payment going forward. You may hear the phrase “debt-to-income ratio.”

That’s what this number is. The lower your ratio, the higher chance you have of getting approved. Now you know why banks care about your down payment amount, your credit score, your monthly loan payments, and income. You can understand why they require so much information and so many financial documents from you.

They will review your bank statements to make sure you can afford the down payment you are planning on making. They will ask for your social security number, so they can review your credit. They’ll check how you’ve paid your bills in the past. Also, they’ll review what loan payments you’re making every month.

They’ll look at pay stubs, tax documents, and your bank statements to validate how much money you make. A loan is unique. It’s the only thing you buy that the seller is going to want back!

When you buy a shirt, the store doesn’t want it back, so it doesn’t care about your situation and all that documentation.

In the next video, we’ll talk about the total cost of your mortgage and the best ways to compare mortgage options.