What is the Home Buying Process? Before we get started on the process and the key players, let’s get one thing straight, out of everyone involved, you are the most important person in the home buying process.

After you complete your budget, ask yourself a simple question. Are you comfortable buying a home based on your monthly budget and your savings goals? This is so important. While real estate agents and loan officers are professionals and have a responsibility to help you, it’s still key to remember that they get paid when you buy a home. If you are a little nervous, that’s ok.

This is a big decision, but if you are truly uncomfortable at any point in the process, you should stop and reassess your financial situation and savings goals. Your real estate agent works for you.

They will have on-the-ground knowledge of your local housing market and will help you decide which neighborhoods and homes may be right for you based on your home price target and other things that may be important to you such as schools, parks, transportation options, or proximity to restaurants and entertainment.

Your real estate agent is considered a buyer’s agent, because they represent you, the home buyer. Once you find a home you like, the person selling that home will likely have their own real estate agent; this is the seller’s agent. The seller pays his agent a commission when the home they sell the home, and that agent will split the commission with your agent.

These 2 real estate agents will also facilitate negotiations between you and the seller regarding the price and other terms of the home purchase agreement. Another person involved in the process is your loan officer who will help you obtain a mortgage.

Although this will be your primary contact with the bank that you choose, the loan officer has a team of people who work behind the scenes, organizing your financial documents, ordering appraisals, approving your mortgage application, and creating the mortgage documents you’ll be asked to sign at the closing table.

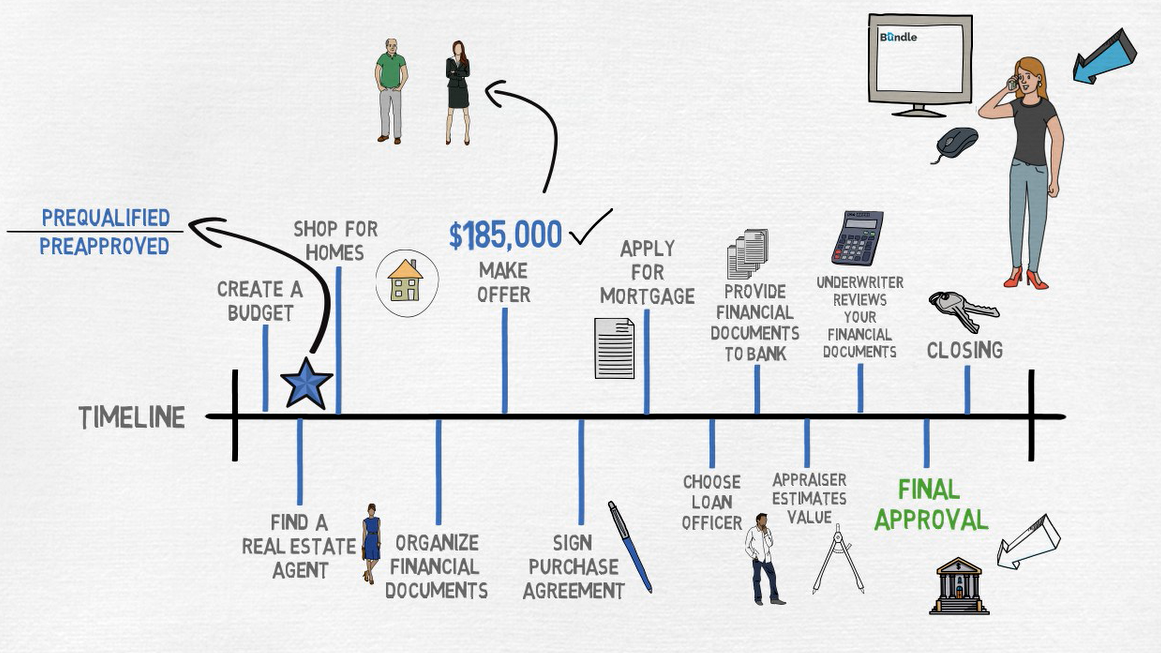

So, what is the process? After you complete your budget and you want to move forward, find a real estate agent. Ask your friends and family for recommendations or search online. You can also use Bundle.

You and your real estate agent will go together and tour homes that are for sale in your area. While you are shopping for a home, it’s also a good time to start organizing your financial documents that you will need to provide to your loan officer.

After you find a home that you love, you and your real estate agent will determine how much you would like to offer the seller to buy the home, and your real estate agent will present that offer to the seller and the seller’s real estate agent. Once you settle on a home price and the terms, you’ll sign a purchase agreement.

At this point, you will have all the pieces you need to apply for a mortgage. Your real estate agent will be able to recommend loan officer’s that they prefer.

You don’t have to use these recommendations but remember real estate agents have gone through this process many times with previous home buyers and their recommendations should reflect the experience of those customers.

Make sure you get the best deal on your mortgage by comparing current mortgage rates.

By using Bundle, you’re in charge and you reach out to loan officer of your choice. You can base your decision on their profile and their mortgage bid.

Next, you’ll provide all your financial documents to your loan officer as part of the approval process.

After that, the bank will order an appraisal to make sure the property is worth what you are offering. They will look at your credit history and all your financial information and documentation. Then they’ll determine if they are comfortable issuing a final approval for your mortgage.

If everything checks out, they will issue an approval. This gives you the green light to close on your home and get the keys. Before you search for a house, your real estate agent may request you get pre-qualified or pre-approved before you start shopping. What does this mean?

Your budget makes you comfortable that you can afford a home. A full and final approval makes the bank comfortable that you can afford a home. A prequalification or preapproval is meant to make both real estate agents and the home seller comfortable that you can afford the home you choose.

This can impact their decision to choose your offer over other home buyers’ offers.

A prequalification is based on the information you give. The bank assumes this information is complete and accurate without validating all the information.

A pre-approval goes an extra step by validating the information you provide by reviewing your financial documents.

See more here.

This is the last video of the Bundle 5 videos. We hope you found this information is helpful. Our goal at Bundle is to make the mortgage process comfortable for you. We want you to make the right decision.