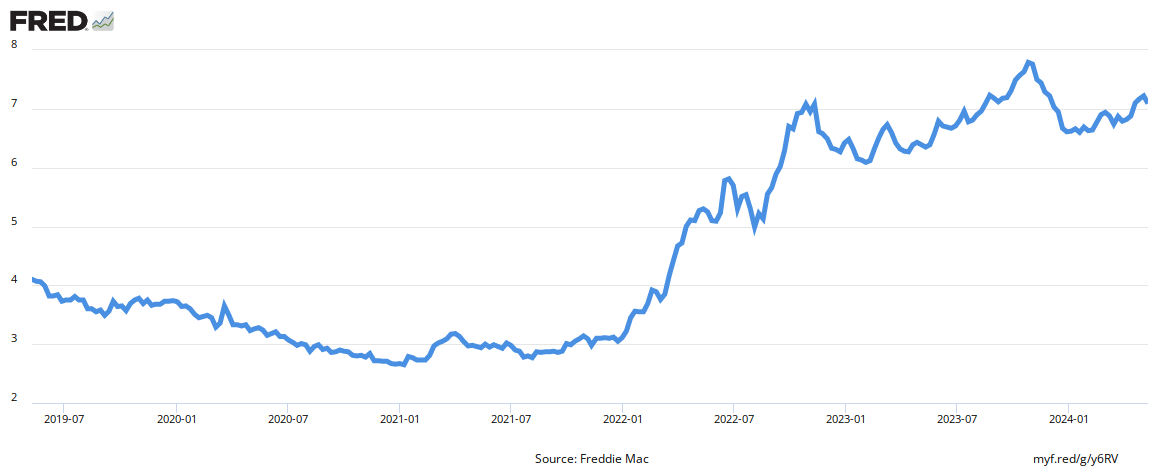

At Bundle, we monitor 30 year fixed mortgage rates in the Freddie Mac Primary Mortgage Market Survey (PPMS) because we believe this is the most accurate way to compare today's mortgage rates to historical mortgage rates. Your rates may vary depending on your credit profile.

The PMMS is focused on conventional, conforming fully-amortizing home purchase loans for borrowers who put 20% down and have excellent credit. The data above is for 30 year fixed rate mortgages.

What are Mortgage Points?

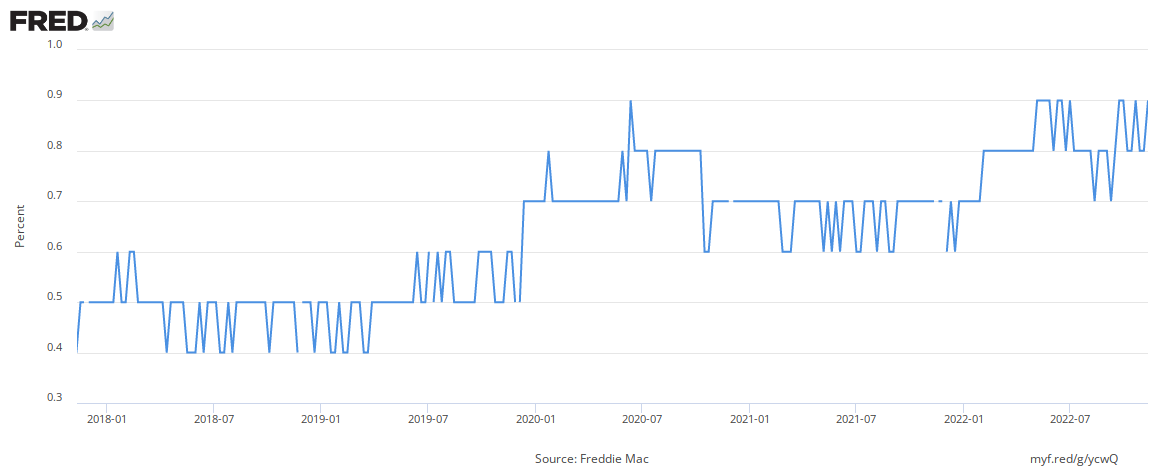

Mortgage points, also known as discount points, are fees paid at closing for a lower interest rate. Read more here.

If a bank charges 0.5 points, that means you’ll pay half of one percent of the mortgage amount upfront. For example, if you borrow $100,000, 0.5 points would translate to $500 ($100,000 X 0.5%).

In addition to points, banks also charge additional fees. In the graph below, you can see the points and fees that banks are currently charging.

A bank might offer a low interest rate, but charge high fees and points. This makes it difficult to compare mortgages.

How Should I Compare Mortgage Rates?

Banks are required to send you a loan estimate after you apply for a mortgage. You’ll find a comparisons section on the 3rd page of the loan estimate.

Annual percentage rate, or APR, combines up-front charges with monthly charges going forward and presents them as a rate. Some people find this difficult to understand, because we don’t buy things in percentages in our daily lives. The cashier at the grocery store doesn’t give you a percentage when you check out. They give you a dollar amount.

That’s why, if you’re going to focus on one comparison, “in five years” is a good choice. This shows you the total amount you’ll pay over a five-year period, along with the amount of the mortgage balance you’ll have paid off.

When you receive mortgage quotes from loan officers on Bundle, you’ll be able to compare both the APR and the “in 5 years” numbers side-by-side of each bid.

What are Personalized Mortgage Rates?

When you search for mortgage rates online, you are looking at advertised mortgage rates. These advertised rates often assume a nearly perfect credit score and a large down payment.

It’s important to request personalized quotes so you can compare mortgage costs based on your individual situation.

If you don’t have a 20% down payment, you’ll need mortgage insurance. You may also have additional interest rate adjustments based on your down payment, credit profile, or other factors.

How Do I Find the Best Mortgage Rates?

First, as we just discussed, it’s important to compare the total cost of your mortgage and not just the interest rate. A bank might send you a quote for a low interest rate, but charge you high fees and points that completely offset the benefit of the lower interest rate.

Unless you talk with every bank, it’s impossible to guarantee you are receiving the absolute best mortgage rate. We recommend you compare at least 3 mortgage banks when you are ready to apply for a mortgage. Make sure you tell the banks that you are shopping around so they give you the best quote.

When you use Bundle, we automatically connect you with 3 loan officers licensed in your area.

What is the Difference between a Mortgage Rate and Annual Percentage Rate (APR)?

An interest rate, or note rate, is a percentage of the borrowed amount or principal charged by a lender for the borrower to use the lender’s money. This is the primary cost of your mortgage. Read more here.

Annual Percentage Rate (APR) is a more comprehensive measure of the total cost of your mortgage than interest rate. APR includes fees and finance charges along with the interest you’ll pay on your mortgage. Read more here.

What is a Conforming Mortgage?

A conforming mortgage is a loan that meets the approval guidelines of Fannie Mae or Freddie Mac, the 2 largest Government Sponsored Enterprises (GSEs). Generally, you’ll need a 680 credit score, 36% DTI, and a 5% down payment to qualify. There’s some wiggle room with these numbers if you have a very high credit score, for example. There are also loan size limits based on your city.

What is a Jumbo Mortgage?

A Jumbo mortgage is a mortgage with a loan balance that is above the conforming loan limits. Many banks offer Jumbo loans for their clients even though they are not able to sell these loans to Fannie Mae or Freddie Mac.

What is a VA Mortgage?

If you are a veteran, you should consider a VA mortgage loan.

The US Department of Veterans Affairs summarizes the benefit they provide on their website:

VA helps Servicemembers, Veterans, and eligible surviving spouses become homeowners. As part of our mission to serve you, we provide a home loan guaranty benefit and other housing-related programs to help you buy, build, repair, retain, or adapt a home for your own personal occupancy.

VA Home Loans are provided by private lenders, such as banks and mortgage companies. VA guarantees a portion of the loan, enabling the lender to provide you with more favorable terms.

What is a USDA Mortgage?

If you are buying a home in a rural area, you should consider a USDA mortgage loan.

The US Department of Agriculture summarizes the benefit they provide on their website:

The program assists approved lenders in providing low- and moderate-income households the opportunity to own adequate, modest, decent, safe and sanitary dwellings as their primary residence in eligible rural areas. Eligible applicants may purchase, build, rehabilitate, improve or relocate a dwelling in an eligible rural area with 100% financing.

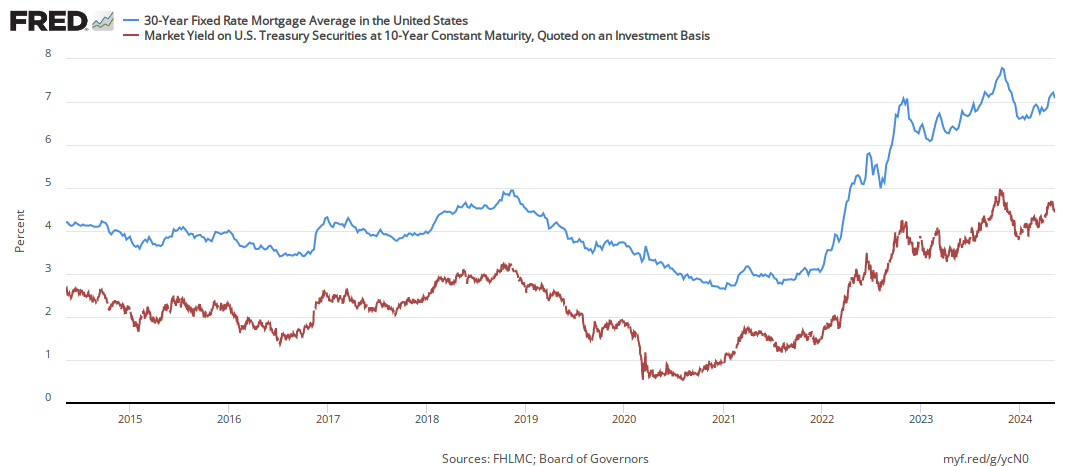

What Determines Today’s Mortgage Rates?

Mortgage rates are primarily driven by the overall interest rate market including government and corporate bonds. Mortgage lenders add a margin on top of a base interest rate to cover their costs of originating a mortgage loan. See how closely mortgage rates track alongside the 10-year treasury rate below. For a more detailed analysis, here is a great resource on the MBS market.

What is a Mortgage Rate Lock?

Mortgage rates change every day based on the market and many other factors. Sometimes mortgage rates can even change multiple times per day. This is why banks allow you to lock in your mortgage rate. As an example, if rates, are 3.5% today, you can call your loan officer and request to lock that rate in. That way, if rates jump to 4%, your mortgage will still be 3.5% even if you haven’t closed yet. When you lock your rate, the bank will take out a little insurance policy to make sure they can keep this promise to you without losing any money on their end.

What are the Top Mortgage Banks?

While Quicken and Wells Fargo Bank were neck and neck in 2018, Quicken pulled away substantially in 2019. They originated $140 Billion which accounts for 6.5% of total mortgages. The top 5 mortgage originators account for nearly 1 in 4 mortgages in the US (22.7%). See the complete list here.

| QUICKEN LOANS | $141.5B | Website |

| WELLS FARGO BANK | $105.2B | Website |

| UNITED SHORE | $103.4B | Website |

| BANK OF AMERICA | $72.6B | Website |

| JPMORGAN CHASE BANK | $62.6B | Website |

See the complete list here.

What is a Discount Point?

Also known as mortgage points, fees paid at closing of your mortgage for a lower interest rate. Read more here.

What is a Lender Credit?

Amounts that decrease the upfront costs of your mortgage but likely result in a higher interest rate. Read more here.

What is a Down Payment?

The difference between the home price and the mortgage amount the home buyer pays the home seller for the closing to occur. Read more here.

What is Mortgage Insurance?

An insurance policy paid by borrowers with low down payments to offset the increased default (non-payment) risk associated with low down payment mortgages. Read more here.

How Much House Can I Afford?

Home buyers can afford a home that costs three times their annual income. That’s the quick answer, but you may want to be a little more conservative or a little more aggressive.

You’ll be able to change assumptions with our how much house can I afford calculator. Or use this fun quiz to find out how much house I can afford. It only takes a few minutes and you’ll be able to review a personalized evaluation at the end.

Banks and real estate agents make more money when you buy a more expensive home. Most of the time, banks will pre-approve you for the most that you can possibly afford. Right out of the gate, before you start touring homes, your budget will be stretched to the max.

It’s important to make sure that you are comfortable with your monthly payment and the amount of money you’ll have left in your bank account after you buy your home.