We’ve updated our list of the top mortgage companies in Tampa.

Mortgage lenders originated 13 million loans in the U.S. in 2020. We’ve gone a little deeper and analyzed the data for Tampa.

The Full List – Top Mortgage Companies in Tampa

Here is our list of the largest mortgage companies in Tampa.

| $ Rank | # Rank | Mortgage Company | Units | Volume ($Millions) |

|---|---|---|---|---|

| 1 | 1 | QUICKEN LOANS INC. | 12,237 | $2,757 |

| 2 | 2 | UNITED SHORE FINANCIAL SERVICES, LLC | 7,211 | $1,856 |

| 3 | 4 | CALIBER HOME LOANS, INC. | 6,284 | $1,630 |

| 4 | 3 | FREEDOM MORTGAGE CORPORATION | 6,316 | $1,542 |

| 5 | 5 | EAGLE HOME MORTGAGE, LLC | 3,171 | $825 |

| 6 | 7 | GUARANTEED RATE, INC. | 2,662 | $766 |

| 7 | 8 | WELLS FARGO BANK, NATIONAL ASSOCIATION | 2,653 | $729 |

| 8 | 11 | REGIONS BANK | 2,391 | $723 |

| 9 | 9 | TRUIST BANK | 2,411 | $701 |

| 10 | 12 | HOME POINT FINANCIAL CORPORATION | 2,381 | $620 |

| 11 | 10 | LOANDEPOT.COM, LLC | 2,406 | $618 |

| 12 | 6 | SUNCOAST CREDIT UNION | 2,998 | $561 |

| 13 | 13 | BANK OF AMERICA, NATIONAL ASSOCIATION | 2,172 | $541 |

| 14 | 14 | VAN DYK MORTGAGE CORPORATION | 2,157 | $529 |

| 15 | 18 | JPMORGAN CHASE BANK, NATIONAL ASSOCIATION | 1723 | $516 |

| 16 | 17 | PENNYMAC LOAN SERVICES, LLC | 1,810 | $470 |

| 17 | 15 | AMERIFIRST FINANCIAL CORPORATION | 2,080 | $466 |

| 18 | 16 | NATIONSTAR MORTGAGE LLC | 1,926 | $423 |

| 19 | 19 | CROSSCOUNTRY MORTGAGE, INC. | 1,654 | $421 |

| 20 | 20 | FAIRWAY INDEPENDENT MORTGAGE CORPORATION | 1,589 | $412 |

| 21 | 22 | HOMEBRIDGE FINANCIAL SERVICES, INC. | 1,507 | $407 |

| 22 | 24 | FBC MORTGAGE, LLC | 1,434 | $406 |

| 23 | 21 | THE MORTGAGE FIRM, INC. | 1581 | $380 |

| 24 | 25 | NFM, INC. | 1,293 | $375 |

| 25 | 22 | DHI MORTGAGE COMPANY, LTD. | 1507 | $372 |

Our list is based on the 2020 HMDA loan level database. We exclude subordinate liens and commercial properties.

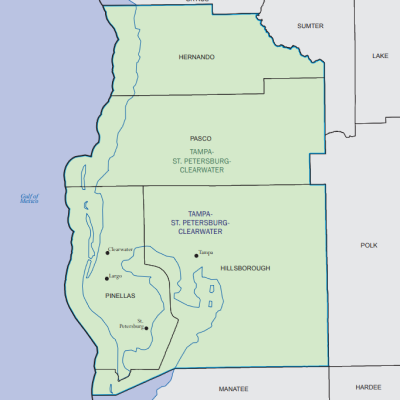

The Tampa MSA is based on the counties identified by the OMB. Therefore, the following counties are included:

- Hernando County

- Hillsborough County

- Pasco County

- Pinellas County

How Should I Compare the Top Mortgage Companies in Tampa?

Banks are required to send you a loan estimate after you apply for a mortgage. You’ll find a comparisons section on the 3rd page of the loan estimate.

Annual percentage rate, or APR, combines up-front charges with monthly charges going forward and presents them as a rate. Some people find this difficult to understand, because we don’t buy things in percentages in our daily lives. The cashier at the grocery store doesn’t give you a percentage when you check out. They give you a dollar amount.

That’s why, if you’re going to focus on one comparison, “in five years” is a good choice. This shows you the total amount you’ll pay over a five-year period, along with the amount of the mortgage balance you’ll have paid off.

When you receive mortgage quotes from loan officers on Bundle, you’ll be able to compare both the APR and the “in 5 years” numbers side-by-side of each bid.

What are Custom Mortgage Rates?

When you search for mortgage rates online, you are looking at advertised mortgage rates. These advertised rates often assume a nearly perfect credit score and a large down payment.

It’s important to request personalized quotes so you can compare mortgage costs based on your individual situation.

If you don’t have a 20% down payment, you’ll need mortgage insurance. You may also have additional interest rate adjustments based on your down payment, credit profile, or other factors.

How Do I Find the Best Mortgage Rates?

First, as we just discussed, it’s important to compare the total cost of your mortgage and not just the interest rate. A bank might send you a quote for a low interest rate, but charge you high fees and points that completely offset the benefit of the lower interest rate.

Unless you talk with every bank, it’s impossible to guarantee you are receiving the absolute best mortgage rate. We recommend you compare at least 3 mortgage banks when you are ready to apply for a mortgage. Make sure you tell the banks that you are shopping around so they give you the best quote.

When you use Bundle, we automatically connect you with 3 loan officers licensed in your area.