We’ve updated our list of the largest mortgage companies in 2021. Last year (2021), mortgage lenders originated 13 million loans for a combined $4.2 Trillion. Here’s a list of the largest mortgage companies.

The Top Mortgage Lenders Ranked by Volume

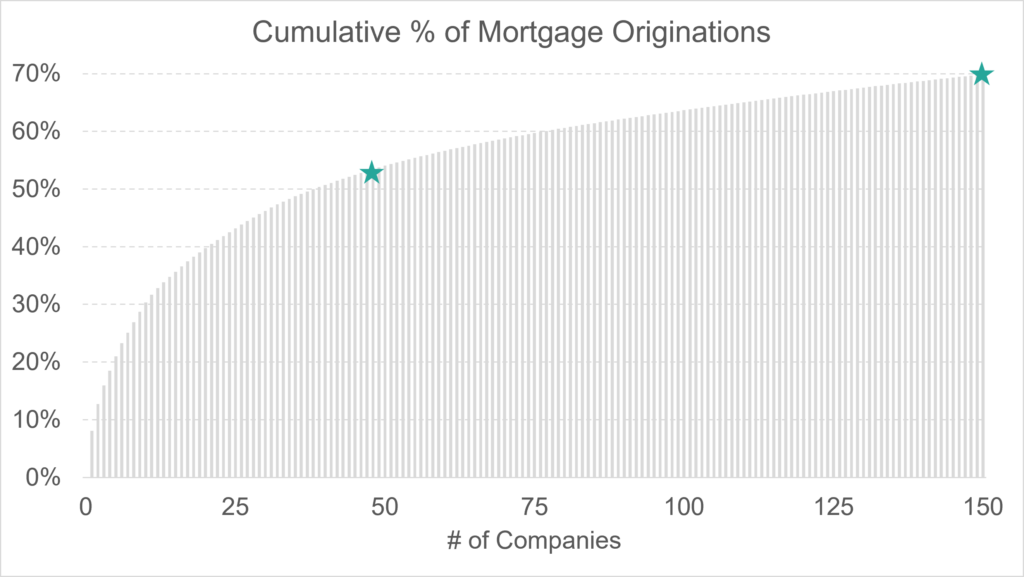

The top 150 lenders in the country account for 72% of all mortgage originations in the country. The top 50 companies alone account for 57% of the mortgage market. Let’s see how they stack up against each other.

The Super Heavyweight | #1 Top Mortgage Lender | $300 Billion +

Quicken holds onto the number one spot in 2021. They originated $340 Billion which accounts for 8.1% of total mortgages (which is the same market share they had in 2020).

| QUICKEN LOANS | $340.1B | Website |

The Heavyweights | Top Mortgage Lenders (#2 & #3) | $100-$250 Billion

United Wholesale Mortgage (UWM), the #1 wholesale lender joins Wells Fargo, the first depository on the list, loanDepot, and JPMorgan Chase. These 4 companies account for 14% of mortgage volume in the US.

| UNITED WHOLESALE MORTGAGE | $211.0B | Website |

| WELLS FARGO BANK | $141.1B | Website |

| LOANDEPOT.COM | $127.7B | Website |

| JPMORGAN CHASE BANK | $106.0B | Website |

The Light Heavyweights | $70-$100 Billion

Bank of America joins four of the largest independent mortgage companies in America for this group. Together, these five companies originate 9% of all mortgages in America.

| FREEDOM MORTGAGE | $89.5B | Website |

| BANK OF AMERICA | $76.0B | Website |

| CALIBER HOME LOANS | $70.8B | Website |

| HOME POINT FINANCIAL | $70.2B | Website |

| GUARANTEED RATE | $70.0B | Website |

The Super Middleweights | $40-$70 Billion

Fairway comes in a the #10 largest lender in the country. If you’re keeping track, 3 out of every 10 people get their mortgage from a top 10 lender.

| FAIRWAY MORTGAGE | $67.7B | Website |

| US BANK | $57.3B | Website |

| PENNYMAC LOAN SERVICES, LLC | $56.9B | Website |

| CROSS COUNTRY MORTGAGE | $49.4B | Website |

| BETTER MORTGAGE CORPORATION | $44.7B | Website |

| NATIONSTAR MORTGAGE (MR. COOPER) | $40.4B | Website |

The Middleweights | $25-$40 Billion

These lenders all originate more than $25 Billion a year or $2 Billion a month! Together, these 9 companies account for 12.2% of the total mortgage market.

| AMERISAVE MORTGAGE COMPANY | $35.1 | Website |

| NEWREZ LLC | $34.0 | Website |

| FLAGSTAR BANK | $33.9B | Website |

| GUILD MORTGAGE COMPANY | $33.5B | Website |

| MOVEMENT MORTGAGE | $32.9B | Website |

| VETERANS UNITED | $31.4B | Website |

| NEW AMERICAN FUNDING | $31.3B | Website |

| CARDINAL FINANCIAL | $30.6B | Website |

| FINANCE OF AMERICA | $29.2B | Website |

| CITIZENS BANK | $28.2B | Website |

| FIRST REPUBLIC | $27.4B | Website |

| PNC BANK N.A. | $27.2B | Website |

The Full List – Top Mortgage Lenders

| $ Rank | # Rank | Mortgage Company | Volume ($Billions) | Units | Avg. Loan Size |

|---|

$ Rank | # Rank | Mortgage Company | Volume ($Billions) | Units | Avg. Loan Size |

|---|---|---|---|---|---|

| 1 | 1 | ROCKET MORTGAGE | $340.06 | 1,236,544 | $275,007 |

| 2 | 2 | UNITED WHOLESALE MORTGAGE | $210.99 | 600,145 | $351,570 |

| 3 | 3 | WELLS FARGO BANK NA | $141.14 | 374,750 | $376,629 |

| 4 | 4 | LOANDEPOT.COM, LLC | $127.73 | 360,596 | $354,229 |

| 5 | 6 | JPMORGAN CHASE BANK, NA | $106.04 | 258,704 | $409,876 |

| 6 | 5 | FREEDOM MORTGAGE CORPORATION | $89.48 | 360,149 | $248,461 |

| 7 | 15 | BANK OF AMERICA NA | $76.05 | 142,877 | $532,255 |

| 8 | 7 | CALIBER HOME LOANS, INC. | $70.82 | 226,727 | $312,349 |

| 9 | 10 | HOME POINT FINANCIAL CORPORATION | $70.20 | 196,679 | $356,943 |

| 10 | 11 | GUARANTEED RATE, INC | $69.99 | 180,162 | $388,497 |

| 11 | 8 | FAIRWAY INDEPENDENT MORT CORP | $67.75 | 213,131 | $317,868 |

| 12 | 13 | US BANK, N.A. | $57.35 | 148,816 | $385,367 |

| 13 | 9 | PENNYMAC LOAN SERVICES LLC | $56.90 | 197,413 | $288,236 |

| 14 | 14 | CROSSCOUNTRY MORTGAGE, LLC | $49.40 | 145,168 | $340,272 |

| 15 | 17 | BETTER MORTGAGE CORPORATION | $44.69 | 124,916 | $357,775 |

| 16 | 12 | NATIONSTAR MORTGAGE | $40.36 | 174,777 | $230,903 |

| 17 | 18 | AMERISAVE MORTGAGE COMPANY | $35.06 | 123,313 | $284,340 |

| 18 | 16 | NEWREZ LLC | $34.04 | 136,896 | $248,686 |

| 19 | 21 | FLAGSTAR BANK | $33.89 | 108,160 | $313,317 |

| 20 | 19 | GUILD MORTGAGE COMPANY LLC | $33.53 | 113,113 | $296,421 |

| 21 | 20 | MOVEMENT MORTGAGE, LLC | $32.85 | 108,601 | $302,496 |

| 22 | 22 | VETERANS UNITED | $31.40 | 107,729 | $291,464 |

| 23 | 24 | NEW AMERICAN FUNDING | $31.29 | 101,930 | $306,974 |

| 24 | 23 | CARDINAL FINANCIAL COMPANY, LI | $30.64 | 103,861 | $295,010 |

| 25 | 27 | FINANCE OF AMERICA MORTGAGE LLC | $29.21 | 78,134 | $373,809 |

| 26 | 25 | CITIBANK, N.A. | $28.18 | 88,706 | $317,732 |

| 27 | 97 | FIRST REPUBLIC BANK | $27.37 | 19,848 | $1,379,005 |

| 28 | 28 | PNC BANK N.A. | $27.20 | 74,170 | $366,660 |

| 29 | 26 | NAVY FEDERAL CREDIT UNION | $24.56 | 78,768 | $311,760 |

| 30 | 64 | CITIBANK, N.A. | $23.92 | 27,010 | $885,618 |

| 31 | 30 | TRUIST BANK | $22.43 | 72,180 | $310,812 |

| 32 | 29 | PRIMELENDING | $21.95 | 73,287 | $299,519 |

| 33 | 33 | HOMEBRIDGE FINANCIAL SERVICES, INC. | $21.28 | 58,154 | $365,946 |

| 34 | 38 | AMERICAN PACIFIC MORTGAGE CORPORATION | $20.02 | 50,740 | $394,468 |

| 35 | 35 | CMG MORTGAGE INC. | $18.08 | 56,519 | $319,816 |

| 36 | 32 | LAKEVIEW LOAN SERVICING, LLC | $17.28 | 66,735 | $258,872 |

| 37 | 31 | HUNTINGTON NATIONAL BANK | $16.75 | 66,818 | $250,675 |

| 38 | 36 | DHI MORTGAGE COMPANY LIMITED | $16.10 | 54,127 | $297,367 |

| 39 | 37 | SUPREME LENDING/EVERETT FINANCIAL INC. | $15.67 | 52,404 | $299,006 |

| 40 | 148 | MORGAN STANLEY PRIVATE BANK NA | $15.66 | 13,213 | $1,184,833 |

| 41 | 43 | KEYBANK NATIONAL ASSOCIATION | $15.41 | 41,298 | $373,259 |

| 42 | 40 | PARAMOUNT RESIDENTIAL MORTGAGE | $15.28 | 49,020 | $311,700 |

| 43 | 41 | ACADEMY MORTGAGE CORPORATION | $15.28 | 48,114 | $317,534 |

| 44 | 42 | PROSPERITY HOME MORTGAGE, LLC | $15.25 | 43,903 | $347,363 |

| 45 | 49 | GUARANTEED RATE AFFINITY, LLC | $14.72 | 36,998 | $397,988 |

| 46 | 47 | LENNAR MORTGAGE, LLC | $13.15 | 37,611 | $349,764 |

| 47 | 39 | REGIONS BANK | $12.39 | 49,595 | $249,892 |

| 48 | 46 | AMERICAN FINANCIAL NETWORK, INC. | $12.18 | 38,499 | $316,323 |

| 49 | 135 | MUFG UNION BANK, NA | $11.91 | 14,487 | $821,875 |

| 50 | 79 | TD BANK | $11.55 | 23,285 | $496,010 |

| 51 | 34 | FIFTH THIRD BANK, NATIONAL ASSOCIATION | $11.37 | 57,665 | $197,142 |

| 52 | 45 | PRIMARY RESIDENTIAL MORTGAGE, INC. | $11.09 | 38,638 | $286,907 |

| 53 | 172 | CHARLES SCHWAB BANK, SSB | $10.72 | 11,142 | $961,852 |

| 54 | 100 | ALLY BANK | $10.32 | 19,388 | $532,390 |

| 55 | 52 | PROVIDENT FUNDING ASSOCIATES | $9.59 | 32,627 | $294,074 |

| 56 | 62 | CORNERSTONE HOME LENDING, INC. | $9.51 | 27,686 | $343,570 |

| 57 | 61 | THE FEDERAL SAVINGS BANK | $9.51 | 27,895 | $340,955 |

| 58 | 67 | DRAPER AND KRAMER MORTGAGE CORP. | $9.29 | 24,978 | $371,826 |

| 59 | 44 | UNION HOME MORTGAGE | $9.28 | 39,932 | $232,337 |

| 60 | 51 | MUTUAL OF OMAHA MORTGAGE | $9.23 | 33,689 | $274,082 |

| 61 | 63 | NFM, INC | $9.12 | 27,200 | $335,189 |

| 62 | 58 | SUN WEST MORTGAGE COMPANY, INC | $8.84 | 28,953 | $305,431 |

| 63 | 65 | AMERIS BANK | $8.76 | 26,692 | $328,091 |

| 64 | 68 | STEARNS LENDING, LLC | $8.58 | 24,836 | $345,354 |

| 65 | 77 | CHERRY CREEK MORTGAGE | $8.57 | 23,485 | $364,879 |

| 66 | 56 | USAA FEDERAL SAVINGS BANK | $8.36 | 30,018 | $278,345 |

| 67 | 71 | PENTAGON FEDERAL CREDIT UNION | $8.20 | 24,298 | $337,611 |

| 68 | 48 | CARRINGTON MORTGAGE SERVICES L | $8.04 | 37,216 | $216,090 |

| 69 | 74 | BAY EQUITY LLC | $8.03 | 23,779 | $337,696 |

| 70 | 53 | GATEWAY FIRST BANK | $7.86 | 31,835 | $246,952 |

| 71 | 54 | AMERICAN FINANCING CORPORATION | $7.70 | 30,391 | $253,502 |

| 72 | 103 | UMPQUA BANK | $7.63 | 19,063 | $400,194 |

| 73 | 122 | CHANGE LENDING, LLC | $7.57 | 16,673 | $453,878 |

| 74 | 296 | CITY NATIONAL BANK | $7.53 | 5,417 | $1,390,763 |

| 75 | 282 | UBS BANK USA | $7.51 | 5,744 | $1,307,866 |

| 76 | 87 | SUMMIT FUNDING.INC | $7.47 | 21,227 | $351,709 |

| 77 | 89 | PULTE MORTGAGE LLC | $7.43 | 21,044 | $353,130 |

| 78 | 60 | LOWER, LLC | $7.41 | 28,217 | $262,713 |

| 79 | 105 | CELEBRITY HOME LOANS, LLC | $7.39 | 18,961 | $389,997 |

| 80 | 75 | SIERRA PACIFIC MORTGAGE CO. INC | $7.27 | 23,632 | $307,559 |

| 81 | 69 | BARRINGTON BANK & TRUST, NA | $7.03 | 24,495 | $287,043 |

| 82 | 134 | AMWEST FUNDING CORP | $6.96 | 14,548 | $478,756 |

| 83 | 83 | NORTHPOINTE BANK | $6.96 | 22,114 | $314,598 |

| 84 | 70 | ARK-LA-TEX FINANCIAL SERVICES LLC | $6.95 | 24,368 | $285,117 |

| 85 | 81 | INTERCONTINENTAL CAPITAL GROUP | $6.94 | 23,008 | $301,462 |

| 86 | 121 | LENDUS, LLC | $6.91 | 16,752 | $412,196 |

| 87 | 116 | FIRST HORIZON BANK | $6.88 | 17,237 | $399,222 |

| 88 | 73 | NOVA HOME LOANS | $6.72 | 24,004 | $279,833 |

| 89 | 50 | STATE EMPLOYEES' CREDIT UNION | $6.71 | 34,673 | $193,659 |

| 90 | 55 | VILLAGE CAPITAL & INVESTMENT | $6.70 | 30,026 | $223,241 |

| 91 | 76 | ATLANTIC BAY MORTGAGE GROUP | $6.64 | 23,496 | $282,576 |

| 92 | 109 | NBKC BANK | $6.63 | 18,347 | $361,447 |

| 93 | 88 | RESIDENTIAL MORTGAGE SERVICES | $6.44 | 21,194 | $303,924 |

| 94 | 90 | FIRSTBANK | $6.37 | 20,975 | $303,799 |

| 95 | 107 | WYNDHAM CAPITAL MORTGAGE, INC | $6.26 | 18,651 | $335,459 |

| 96 | 91 | SWBC MORTGAGE CORPORATION | $6.25 | 20,951 | $298,337 |

| 97 | 85 | PLAZA HOME MORTGAGE, INC | $6.24 | 21,446 | $290,900 |

| 98 | 96 | BELL BANK | $6.12 | 19,912 | $307,479 |

| 99 | 84 | FIRST GUARANTY MORTGAGE CORPOR | $6.11 | 22,009 | $277,834 |

| 100 | 112 | NVR MORTGAGE FINANCE, INC. | $6.08 | 17,732 | $342,653 |

| 101 | 72 | NEW DAY FINANCIAL, LLC. | $5.83 | 24,163 | $241,141 |

| 102 | 99 | PLANET HOME LENDING, LLC | $5.73 | 19,691 | $291,003 |

| 103 | 126 | FIRST HOME MORTGAGE | $5.68 | 15,300 | $371,218 |

| 104 | 117 | EMBRACE HOME LOANS, INC. | $5.67 | 17,043 | $332,659 |

| 105 | 165 | LEADER BANK NA | $5.55 | 11,605 | $478,213 |

| 106 | 92 | PLAINS COMMERCE BANK | $5.55 | 20,836 | $266,163 |

| 107 | 123 | SOUTH STATE BANK | $5.53 | 16,358 | $338,047 |

| 108 | 141 | FIRST UNITED BANK AND TRUST CO | $5.52 | 13,805 | $399,822 |

| 109 | 95 | HOMETOWN LENDERS, INC. | $5.46 | 19,945 | $273,942 |

| 110 | 78 | M&T BANK | $5.45 | 23,466 | $232,066 |

| 111 | 143 | NJ LENDERS CORP | $5.44 | 13,456 | $403,991 |

| 112 | 140 | MCLEAN MORTGAGE CORPORATION | $5.41 | 13,825 | $391,289 |

| 113 | 128 | NORTH AMERICAN SAVINGS BANK | $5.39 | 14,948 | $360,262 |

| 114 | 102 | AMERICAN NEIGHBORHOOD MORTGAGE ACCEPTANCE COMPANY | $5.38 | 19,066 | $282,079 |

| 115 | 98 | LAKE MICHIGAN CREDIT UNION | $5.37 | 19,747 | $272,073 |

| 116 | 178 | ZIONS BANCORPORATION, N.A. | $5.36 | 10,808 | $496,363 |

| 117 | 59 | RUOFF MORTGAGE COMPANY | $5.33 | 28,243 | $188,753 |

| 118 | 104 | BANK OF ENGLAND | $5.30 | 18,976 | $279,439 |

| 119 | 66 | UNION SAVINGS BANK | $5.29 | 25,133 | $210,618 |

| 120 | 132 | EVERGREEN MONEYSOURCE MORTGAGE COMPANY | $5.23 | 14,778 | $353,808 |

| 121 | 115 | SECURITYNATIONAL MORTGAGE COMPANY | $5.19 | 17,362 | $299,043 |

| 122 | 298 | HSBC BANK USA, NA | $5.12 | 5,393 | $949,022 |

| 123 | 118 | FBC MORTGAGE, LLC | $5.11 | 17,041 | $300,151 |

| 124 | 93 | MID AMERICA MORTGAGE, INC. | $5.11 | 20,393 | $250,410 |

| 125 | 152 | STRONG HOME MORTGAGE, LLC | $5.09 | 13,064 | $389,940 |

| 126 | 219 | BANK OF THE WEST | $5.07 | 8,724 | $581,003 |

| 127 | 159 | GEORGE MASON MORTGAGE, LLC. | $5.02 | 12,368 | $405,831 |

| 128 | 173 | INTERCOASTAL MORTGAGE, LLC | $4.93 | 11,079 | $444,801 |

| 129 | 82 | ARVEST BANK | $4.92 | 22,507 | $218,396 |

| 130 | 110 | AMCAP MORTGAGE LTD | $4.91 | 18,247 | $269,279 |

| 131 | 130 | V.I.P. MORTGAGE, INC. | $4.89 | 14,910 | $328,245 |

| 132 | 101 | NATIONS LENDING CORPORATION | $4.85 | 19,172 | $253,131 |

| 133 | 86 | DAS ACQUISITION COMPANY, LLC | $4.79 | 21,403 | $223,991 |

| 134 | 111 | CHURCHILL MORTGAGE CORPORATION | $4.77 | 17,977 | $265,536 |

| 135 | 108 | RENASANT BANK | $4.76 | 18,417 | $258,193 |

| 136 | 113 | LAKEVIEW COMMUNITY CAPITAL, LL | $4.60 | 17,595 | $261,619 |

| 137 | 125 | HIGHLANDS RESIDENTIAL MORTGAGE | $4.56 | 15,728 | $289,976 |

| 138 | 131 | ENVOY MORTGAGE, LTD | $4.45 | 14,810 | $300,340 |

| 139 | 120 | AMERIHOME MORTGAGE COMPANY, LLC | $4.35 | 16,872 | $257,583 |

| 140 | 169 | SYNERGY ONE LENDING | $4.35 | 11,344 | $383,063 |

| 141 | 215 | STIFEL BANK & TRUST | $4.34 | 8,854 | $490,557 |

| 142 | 138 | ASSOCIATED BANK NA | $4.31 | 14,026 | $307,599 |

| 143 | 175 | FREMONT BANK | $4.31 | 10,976 | $393,001 |

| 144 | 180 | FINANCE OF AMERICA REVERSE LLC | $4.28 | 10,593 | $403,815 |

| 145 | 241 | BBVA USA | $4.27 | 7,654 | $557,929 |

| 146 | 124 | WATERSTONE MORTGAGE CORPORATION | $4.25 | 16,091 | $263,985 |

| 147 | 80 | VANDERBILT MORTGAGE AND FINANCE, INC | $4.25 | 23,058 | $184,205 |

| 148 | 230 | GENERAL MORTGAGE CAPITAL CORPORATION | $4.19 | 8,193 | $511,772 |

| 149 | 293 | SPROUT MORTGAGE, LLC | $4.17 | 5,552 | $751,173 |

| 150 | 136 | KELLER MORTGAGE, LLC | $4.16 | 14,147 | $294,304 |

We used the the 2021 HMDA loan level database to calculate our results. We excluded subordinate liens and commercial properties.