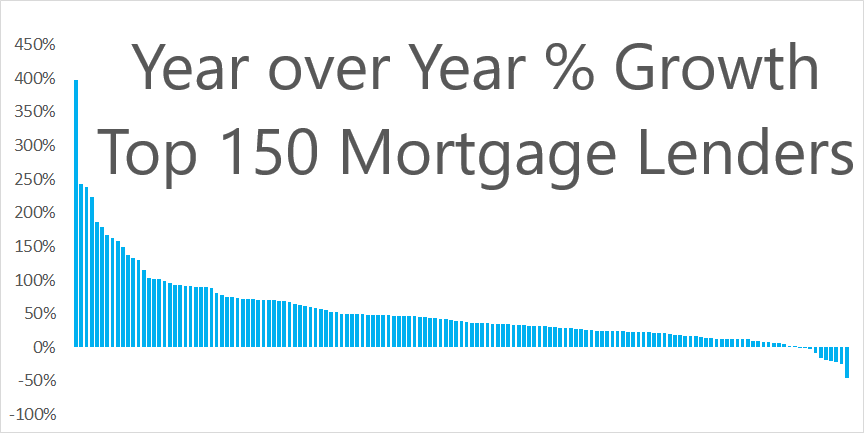

Let’s take a look at the fastest growing mortgage lenders. We recently shared the top mortgage lenders by volume. Almost everyone had a great year. In total, the top 150 mortgage lenders increased originations by 50% compared to 2018!

The Fastest Growing Mortgage Lenders

Since most mortgage lenders had an amazing 2019 (2020: “hold my beer”), we’ll compare the lenders that grew the most on a percentage basis.

| Rank | Mortgage Company | % YoY Growth | 2019 Volume ($B) | 2018 Volume ($B) |

|---|

Rank | Mortgage Company | % YoY Growth | 2019 Volume ($B) | 2018 Volume ($B) | |

|---|---|---|---|---|---|

| 1 | FIRST FEDERAL BANK | 398% | $2.64 | $0.53 | |

| 2 | SYNERGY ONE LENDING, INC. | 243% | $5.45 | $1.59 | |

| 3 | PLANET HOME LENDING, LLC | 239% | $2.65 | $0.78 | |

| 4 | KELLER MORTGAGE, LLC | 223% | $2.97 | $0.92 | |

| 5 | CLEARPATH LENDING | 186% | $2.36 | $0.83 | |

| 6 | AMERISAVE MORTGAGE CORPORATION | 179% | $4.76 | $1.70 | |

| 7 | BETTER MORTGAGE CORPORATION | 167% | $3.57 | $1.34 | |

| 8 | PENNYMAC LOAN SERVICES, LLC | 162% | $13.17 | $5.02 | |

| 9 | NORTHPOINTE BANK | 158% | $3.38 | $1.31 | |

| 10 | UNITED SHORE FINANCIAL SERVICES, LLC | 148% | $103.44 | $41.66 | |

| 11 | SUN WEST MORTGAGE COMPANY, INC. | 137% | $2.72 | $1.15 | |

| 12 | AMERIS BANK | 133% | $4.11 | $1.77 | |

| 13 | SUNTRUST BANKS, INC. | 129% | $10.39 | $4.53 | |

| 14 | FREEDOM MORTGAGE CORPORATION | 114% | $28.55 | $13.34 | |

| 15 | CHARLES SCHWAB BANK | 102% | $3.64 | $1.80 | |

| 16 | SWBC MORTGAGE CORPORATION | 102% | $3.70 | $1.83 | |

| 17 | NFM, INC. | 101% | $3.27 | $1.63 | |

| 18 | CROSSCOUNTRY MORTGAGE, INC. | 98% | $14.30 | $7.23 | |

| 19 | NORTH AMERICAN SAVINGS BANK, F.S.B. | 96% | $2.62 | $1.34 | |

| 20 | DRAPER AND KRAMER MORTGAGE CORP. | 93% | $3.34 | $1.73 | |

| 21 | V.I.P. MORTGAGE, INC. | 93% | $2.48 | $1.29 | |

| 22 | NATIONSTAR MORTGAGE LLC | 92% | $19.44 | $10.15 | |

| 23 | NEWREZ LLC | 92% | $10.15 | $5.30 | |

| 24 | COMMERCE HOME MORTGAGE, INC. | 90% | $2.67 | $1.40 | |

| 25 | PROVIDENT FUNDING ASSOCIATES, L.P. | 90% | $11.36 | $6.00 | |

| 26 | HOME POINT FINANCIAL CORPORATION | 89% | $12.10 | $6.40 | |

| 27 | AMERICAN FINANCIAL NETWORK, INC. | 87% | $7.16 | $3.82 | |

| 28 | MORGAN STANLEY PRIVATE BANK, NATIONAL ASSOCIATION | 80% | $8.55 | $4.75 | |

| 29 | CITIZENS BANK, NATIONAL ASSOCIATION | 78% | $17.71 | $9.95 | |

| 30 | QUICKEN LOANS INC. | 74% | $141.50 | $81.23 | |

| 31 | CARDINAL FINANCIAL COMPANY, LIMITED PARTNERSHIP | 74% | $9.69 | $5.57 | |

| 32 | LAKEVIEW LOAN SERVICING, LLC | 73% | $4.60 | $2.66 | |

| 33 | VANDERBILT MORTGAGE AND FINANCE, INC. | 72% | $2.21 | $1.29 | |

| 34 | AMERICAN FINANCING CORPORATION | 71% | $4.07 | $2.38 | |

| 35 | CITY NATIONAL BANK | 71% | $4.31 | $2.52 | |

| 36 | PROSPERITY HOME MORTGAGE, LLC | 71% | $6.15 | $3.60 | |

| 37 | UNION SAVINGS BANK | 71% | $3.26 | $1.91 | |

| 38 | CITIBANK, NATIONAL ASSOCIATION | 70% | $21.08 | $12.38 | |

| 39 | KEYBANK NATIONAL ASSOCIATION | 69% | $5.98 | $3.53 | |

| 40 | THE FEDERAL SAVINGS BANK | 69% | $5.63 | $3.33 | |

| 41 | BANK OF AMERICA, NATIONAL ASSOCIATION | 69% | $72.60 | $43.02 | |

| 42 | NBKC BANK | 67% | $4.43 | $2.65 | |

| 43 | LEADER BANK, NATIONAL ASSOCIATION | 64% | $2.73 | $1.67 | |

| 44 | CHERRY CREEK MORTGAGE CO., INC. | 62% | $5.05 | $3.11 | |

| 45 | GUARANTEED RATE, INC. | 62% | $26.44 | $16.35 | |

| 46 | WYNDHAM CAPITAL MORTGAGE, INC. | 59% | $2.27 | $1.42 | |

| 47 | BANK OF ENGLAND | 59% | $3.63 | $2.29 | |

| 48 | BROKER SOLUTIONS, INC. | 57% | $14.81 | $9.44 | |

| 49 | VETERANS UNITED HOME LOANS | 55% | $16.37 | $10.55 | |

| 50 | STIFEL BANK AND TRUST | 53% | $2.25 | $1.47 |

Showing 1 to 50 of 50 entries

We used the the 2019 HMDA loan level database to calculate our results. We excluded subordinate liens and commercial properties.