This week, millions of baseball fans will get their first glimpse of their favorite teams as Major League Baseball kicks off its 2019 season. At the same time, mortgage originators are starting to ramp up for their season – the home-buying season.

This week, millions of baseball fans will get their first glimpse of their favorite teams as Major League Baseball kicks off its 2019 season. At the same time, mortgage originators are starting to ramp up for their season – the home-buying season.

But there’s something else that mortgage originators have in common with baseball players. In order to prove it, I have an embarrassing confession to make: I’m a baseball nerd. And not just your run-of-the-mill baseball nerd who wouldn’t miss a game – it’s worse than that.

For the last decade, I’ve been in a fantasy baseball league, the dorkiest fantasy sport of them all. Every year before our draft, I create a huge spreadsheet that has all the players ranked by different stats. You can imagine how “proud” my wife is.

WAR: Wins Above Replacement

In baseball, there are some basic statistics that every casual fan knows: home runs, hits, RBIs, steals, and strikeouts. You’re likely to see these on the bottom of the screen during a televised game.

There’s another layer that goes a bit deeper. In the late 1970s, Bill James popularized a branch of baseball statistics known as sabermetrics, which searches for better measures of baseball performance.

More recently, Michael Lewis’s book Moneyball, and the subsequent movie of the same name starring Brad Pitt, tells the story of how Billy Beane used sabermetrics to assemble his team while managing the Oakland Athletics. And to answer your question, yes, all baseball nerds do look like Brad Pitt.

WAR, or Wins Above Replacement, is one of the more common sabermetric baseball statistics that attempts to assign a value to each player’s contribution to wins over a reasonable replacement.

Let’s go through a real example: In 2018, Mookie Betts, of the Boston Red Sox, led Major League Baseball with a WAR of 10.4. During that same season, the Red Sox won 108 games (incidentally, one of the best seasons for any team in history – I promise I’m not a Red Sox fan).

Remember, WAR stands for Wins Above Replacement and, specifically in our example, what would have happened if the Red Sox hadn’t had Mookie Betts in 2018. Instead, let’s imagine they’d had the next-best guy on their depth chart for the entire season. Since Mookie Betts had an estimated impact of 10 wins above a replacement player, the Red Sox would have won 98 games (108 games minus 10) without him.

WAR in Your Own Career

You can apply this same philosophy of replacement value to your own career as a motivation to be your best at whatever it is you do. You may be able to negotiate a pay increase or, conversely, stop yourself from an impulsive Jerry Maguire “Who’s coming with me?” moment.

It doesn’t matter what type of work you do. You may, for example, install irrigation systems. How many more irrigation systems does your company install with you on the team than with a replacement?

Let’s say you leave your irrigation company on December 31, 2018. In 2018 your team installed 65 irrigation systems. Now they must hire someone to replace you. If, in 2019, the same team, under similar circumstances but with your replacement, installs 50 irrigation systems, your ISAR (Irrigation Systems Above Replacement) would be 15.

LAR: Loans Above Replacement

As a mortgage originator, you probably don’t hit many home runs or install many irrigation systems. Instead, you originate mortgages. Your value to your company is the number of loans you can originate over your next-best replacement.

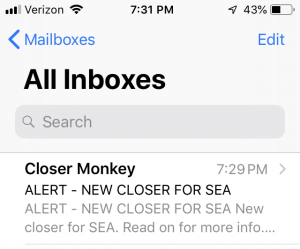

You should, however, know not only what value you bring to your company every day but also what value your company brings to you. Let’s say John, a mortgage originator, sends this email to his boss: “This is ridiculous. You don’t value you me at all! I closed seven loans last month and I need a higher commission or I’m out of here!”

Let’s ignore the email yelling for a second. Your reaction to this message will largely depend on where you sit. If John’s company spends $100 million each year on TV commercials, making his phone ring off the hook every day, 7 loans could be low. Let’s say a similarly situated loan originator closed 15 loans in the previous month, and the next-best replacement could close 12. John’s Loans Above Replacement is negative. His company would originate 5 more loans every month without him on the team, and they’d be better off replacing him!

But let’s assume instead that John works for a regional bank, which opened a branch in John’s hometown a few years ago and immediately hired him. He’s been a staple in his small community for decades and everyone knows him. If John left, the bank’s regional manager doesn’t have a backup plan. She thinks she could find someone who could originate 2 mortgages every month. Here, John’s Loans Above Replacement is positive. The bank would originate 5 fewer loans every month without him on the team.

Plate Appearances

In baseball, when a batter steps up to home plate, that’s their chance to make an impact in the game. Think about the mix of potential customers you have every month. How did those customers find their way to you? This impacts your productivity, but it also impacts the productivity of any prospective replacement.

How many of these customers would find their way to your company if you weren’t there? It might be 100 percent. Your company may buy leads, and those leads may be the only customers you have. Your company may have powerful branding and name recognition or have strong cross-selling and retention processes.

On the other hand, you may personally have a strong referral and repeat-customer base. What percentage of those customers would still find their way to your company if you left? Before you say 0 percent, think through your company’s customer-facing technology and operational efficiencies.

Getting on Base

A batter is productive when he gets on base. Now that a customer has found their way to you, how do you get them to the closing table? Do you have an industry-leading rate sheet? Are you a rock star on the phone and in person? Do you know every product inside out, and might your next-best replacement miss a potential solution?

Just as customer-facing technology and operational efficiencies can increase at bats through referrals and repeat customers, it can also increase base hits by increasing customer satisfaction and lowering the likelihood that they’ll bail on you and go with another lender.

Commission Structure

It’s easy to assume that commission cures all. “It doesn’t matter if John doesn’t close any loans this month – I won’t have to pay him a commission.” What is the company giving up in that scenario? They’re giving up opportunity, the opportunity to have someone else sitting in John’s seat who, with the same tools, could produce more.

Commission accelerators can be a strong tool for some of the most productive originators in the LAR category. You might consider rewarding a high producer by giving her a gradually increasing commission for each loan she closes above a replacement originator.

Happy opening week, and happy home buying season!