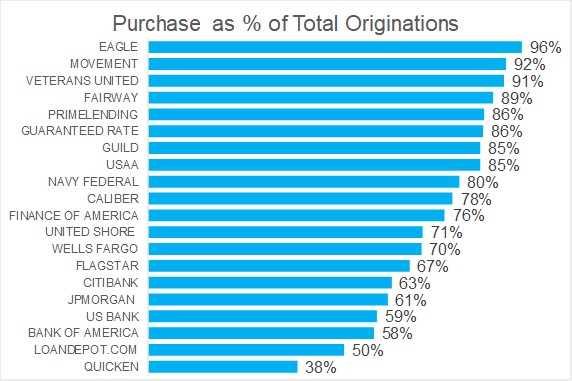

Here are the top purchase mortgage lenders in the country.

When a borrower is using their mortgage to purchase a home, the mortgage is a purchase mortgage. Alternatively, when a borrower applies for a mortgage to replace their existing mortgage for a lower rate or different term, the mortgage is a refinance mortgage.

We recently released our list of the top 150 mortgage lenders in the country. These top 150 lenders account for two-thirds (67%) of all mortgage originations!

Let’s review how these 150 lenders stack up on purchase mortgages. Together, 67% of this group’s mortgage production in 2018 was for borrowers buying a home. There has been a refinance surge in 2019 so this number will be lower this year.

The Full List – Top Purchase Mortgage Lenders

| Rank ($) | Rank (#) | Mortgage Company | Volume ($B) | Units (#) | % of Total |

|---|

Rank ($) | Rank (#) | Mortgage Company | Volume ($B) | Units (#) | % of Total |

|---|---|---|---|---|---|

| 1 | 1 | WELLS FARGO BANK, NATIONAL ASSOCIATION | $55.1 | 134,538 | 70% |

| 2 | 6 | JPMORGAN CHASE BANK, NATIONAL ASSOCIATION | $31.1 | 75,804 | 61% |

| 3 | 2 | QUICKEN LOANS INC. | $31.1 | 131,771 | 38% |

| 4 | 3 | UNITED SHORE FINANCIAL SERVICES, LLC | $29.4 | 104,439 | 71% |

| 5 | 9 | BANK OF AMERICA, NATIONAL ASSOCIATION | $24.9 | 52,857 | 58% |

| 6 | 5 | CALIBER HOME LOANS, INC. | $22.8 | 82,161 | 78% |

| 7 | 4 | FAIRWAY INDEPENDENT MORTGAGE CORPORATION | $22.0 | 89,445 | 89% |

| 8 | 7 | GUARANTEED RATE, INC. | $17.7 | 58,311 | 86% |

| 9 | 10 | LOANDEPOT.COM, LLC | $15.6 | 50,786 | 50% |

| 10 | 17 | US BANK NATIONAL ASSOCIATION | $13.8 | 39,361 | 59% |

| 11 | 8 | GUILD MORTGAGE COMPANY | $13.7 | 54,480 | 85% |

| 12 | 14 | NAVY FEDERAL CREDIT UNION | $12.3 | 44,546 | 80% |

| 13 | 15 | FLAGSTAR BANK, FSB | $12.2 | 43,757 | 67% |

| 14 | 13 | USAA FEDERAL SAVINGS BANK | $11.3 | 45,220 | 85% |

| 15 | 11 | PRIMELENDING, A PLAINSCAPITAL COMPANY | $10.9 | 46,568 | 86% |

| 16 | 12 | MOVEMENT MORTGAGE, LLC | $10.4 | 45,564 | 92% |

| 17 | 18 | FINANCE OF AMERICA MORTGAGE LLC | $10.2 | 34,494 | 76% |

| 18 | 16 | VETERANS UNITED HOME LOANS | $9.6 | 42,773 | 91% |

| 19 | 20 | EAGLE HOME MORTGAGE, LLC | $8.6 | 29,410 | 96% |

| 20 | 48 | CITIBANK, NATIONAL ASSOCIATION | $7.7 | 12,602 | 63% |

| 21 | 21 | DHI MORTGAGE COMPANY, LTD. | $7.4 | 29,004 | 100% |

| 22 | 19 | ACADEMY MORTGAGE CORPORATION | $7.4 | 30,603 | 87% |

| 23 | 23 | STEARNS LENDING, LLC | $7.3 | 26,206 | 75% |

| 24 | 25 | HOMEBRIDGE FINANCIAL SERVICES, INC. | $7.2 | 25,109 | 66% |

| 25 | 22 | BROKER SOLUTIONS, INC. | $7.0 | 26,917 | 74% |

| 26 | 32 | SUNTRUST BANKS, INC. | $6.5 | 17,719 | 66% |

| 27 | 30 | CITIZENS BANK, NATIONAL ASSOCIATION | $6.2 | 18,873 | 62% |

| 28 | 118 | FIRST REPUBLIC BANK | $6.0 | 5,024 | 61% |

| 29 | 26 | FREEDOM MORTGAGE CORPORATION | $6.0 | 23,845 | 45% |

| 30 | 27 | CROSSCOUNTRY MORTGAGE, INC. | $6.0 | 23,793 | 83% |

| 31 | 24 | EVERETT FINANCIAL, INC. | $5.9 | 25,241 | 83% |

| 32 | 28 | CMG MORTGAGE, INC. | $5.4 | 20,777 | 77% |

| 33 | 38 | AMERICAN PACIFIC MORTGAGE CORPORATION | $5.4 | 15,855 | 80% |

| 34 | 34 | PNC BANK, NATIONAL ASSOCIATION | $5.1 | 17,066 | 49% |

| 35 | 42 | NVR MORTGAGE FINANCE, INC. | $4.8 | 15,036 | 100% |

| 36 | 51 | HOMESTREET BANK | $4.6 | 12,192 | 79% |

| 37 | 29 | THE HUNTINGTON NATIONAL BANK | $4.6 | 20,312 | 56% |

| 38 | 115 | MUFG UNION BANK, NATIONAL ASSOCIATION | $4.5 | 5,287 | 57% |

| 39 | 44 | PULTE MORTGAGE LLC | $4.4 | 14,279 | 100% |

| 40 | 66 | TIAA, FSB | $4.4 | 9,855 | 72% |

| 41 | 33 | HOME POINT FINANCIAL CORPORATION | $4.3 | 17,213 | 67% |

| 42 | 36 | PARAMOUNT RESIDENTIAL MORTGAGE GROUP, INC. | $4.2 | 16,351 | 81% |

| 43 | 37 | BRANCH BANKING AND TRUST COMPANY | $4.2 | 16,111 | 58% |

| 44 | 40 | CORNERSTONE HOME LENDING, INC. | $4.2 | 15,324 | 90% |

| 45 | 31 | PACIFIC UNION FINANCIAL, LLC | $4.0 | 17,835 | 66% |

| 46 | 35 | PRIMARY RESIDENTIAL MORTGAGE, INC. | $3.9 | 16,808 | 87% |

| 47 | 39 | REGIONS BANK | $3.8 | 15,506 | 66% |

| 48 | 46 | CARDINAL FINANCIAL COMPANY, LIMITED PARTNERSHIP | $3.5 | 13,573 | 63% |

| 49 | 56 | PROVIDENT FUNDING ASSOCIATES, L.P. | $3.5 | 11,606 | 58% |

| 50 | 53 | PROSPERITY HOME MORTGAGE, LLC | $3.5 | 11,916 | 96% |

| 51 | 55 | LENDUS, LLC | $3.4 | 11,674 | 82% |

| 52 | 47 | RESIDENTIAL MORTGAGE SERVICES, INC. | $3.3 | 13,483 | 90% |

| 53 | 45 | FIFTH THIRD MORTGAGE COMPANY | $3.1 | 13,850 | 78% |

| 54 | 70 | UMPQUA BANK | $3.1 | 9,196 | 72% |

| 55 | 41 | GATEWAY MORTGAGE GROUP, LLC | $3.0 | 15,114 | 83% |

| 56 | 67 | NEWREZ LLC | $3.0 | 9,817 | 56% |

| 57 | 64 | SIERRA PACIFIC MORTGAGE COMPANY, INC. | $2.9 | 9,932 | 71% |

| 58 | 65 | BAY EQUITY LLC | $2.8 | 9,910 | 80% |

| 59 | 57 | FBC MORTGAGE, LLC | $2.8 | 11,548 | 86% |

| 60 | 49 | ATLANTIC BAY MORTGAGE GROUP, L.L.C. | $2.7 | 12,577 | 89% |

| 61 | 52 | FIRSTBANK | $2.7 | 12,023 | 65% |

| 62 | 59 | PLAZA HOME MORTGAGE, INC. | $2.6 | 11,199 | 78% |

| 63 | 78 | FIRST HOME MORTGAGE CORPORATION | $2.6 | 8,365 | 91% |

| 64 | 43 | UNION HOME MORTGAGE CORP. | $2.6 | 14,663 | 88% |

| 65 | 99 | TD BANK, NATIONAL ASSOCIATION | $2.5 | 6,408 | 45% |

| 66 | 54 | FRANKLIN AMERICAN MORTGAGE COMPANY | $2.5 | 11,825 | 77% |

| 67 | 60 | ARK-LA-TEX FINANCIAL SERVICES, LLC. | $2.5 | 10,747 | 90% |

| 68 | 72 | SUMMIT FUNDING, INC. | $2.5 | 8,963 | 85% |

| 69 | 80 | CHERRY CREEK MORTGAGE CO., INC. | $2.5 | 8,238 | 80% |

| 70 | 68 | AMERICAN FINANCIAL NETWORK, INC. | $2.5 | 9,659 | 65% |

| 71 | 61 | ENVOY MORTGAGE, LTD | $2.5 | 10,571 | 87% |

| 72 | 62 | BARRINGTON BANK & TRUST COMPANY, N.A. | $2.5 | 10,341 | 79% |

| 73 | 74 | CITYWIDE HOME LOANS, LLC | $2.4 | 8,717 | 85% |

| 74 | 73 | FIDELITY BANK | $2.4 | 8,812 | 89% |

| 75 | 97 | NEW YORK COMMUNITY BANK | $2.3 | 6,465 | 59% |

| 76 | 50 | STATE EMPLOYEES' CREDIT UNION | $2.3 | 12,557 | 69% |

| 77 | 63 | WATERSTONE MORTGAGE CORPORATION | $2.3 | 10,136 | 91% |

| 78 | 100 | GEORGE MASON MORTGAGE, LLC | $2.3 | 6,324 | 84% |

| 79 | 86 | EVERGREEN MONEYSOURCE MORTGAGE COMPANY | $2.2 | 7,773 | 82% |

| 80 | 71 | LAKE MICHIGAN CREDIT UNION | $2.1 | 9,175 | 85% |

| 81 | 81 | ON Q FINANCIAL, INC. | $2.1 | 8,233 | 86% |

| 82 | 69 | NOVA FINANCIAL & INVESTMENT CORPORATION | $2.1 | 9,318 | 82% |

| 83 | 117 | BBVA USA | $2.1 | 5,238 | 66% |

| 84 | 77 | BOKF, NATIONAL ASSOCIATION | $2.1 | 8,436 | 72% |

| 85 | 76 | HOMESERVICES LENDING, LLC | $2.1 | 8,445 | 94% |

| 86 | 93 | IBERIABANK | $2.0 | 6,632 | 71% |

| 87 | 102 | NBKC BANK | $1.9 | 6,227 | 74% |

| 88 | 142 | MORGAN STANLEY PRIVATE BANK, NATIONAL ASSOCIATION | $1.9 | 2,151 | 40% |

| 89 | 91 | ASSOCIATED BANK, NATIONAL ASSOCIATION | $1.9 | 6,919 | 74% |

| 90 | 75 | BANK OF ENGLAND | $1.9 | 8,528 | 81% |

| 91 | 110 | FIRST CHOICE LOAN SERVICES INC. | $1.8 | 5,694 | 73% |

| 92 | 129 | ZIONS BANCORPORATION, N.A. | $1.8 | 3,357 | 55% |

| 93 | 105 | TOWNE BANK | $1.8 | 6,118 | 82% |

| 94 | 58 | RUOFF MORTGAGE COMPANY, INC. | $1.8 | 11,288 | 92% |

| 95 | 85 | AMERICAN NEIGHBORHOOD MORTGAGE ACCEPTANCE COMPANY LLC | $1.7 | 7,850 | 87% |

| 96 | 144 | UBS BANK USA | $1.7 | 1,863 | 49% |

| 97 | 92 | BELL BANK | $1.7 | 6,723 | 86% |

| 98 | 101 | AMERIFIRST FINANCIAL, INC. | $1.7 | 6,274 | 84% |

| 99 | 82 | AMCAP MORTGAGE, LTD. | $1.7 | 8,083 | 89% |

| 100 | 87 | CARRINGTON MORTGAGE SERVICES, LLC | $1.6 | 7,514 | 33% |

| 101 | 89 | SECURITYNATIONAL MORTGAGE COMPANY | $1.6 | 7,280 | 84% |

| 102 | 113 | THE FEDERAL SAVINGS BANK | $1.6 | 5,456 | 48% |

| 103 | 88 | RENASANT BANK | $1.6 | 7,479 | 74% |

| 104 | 109 | MORTGAGE NETWORK, INC. | $1.6 | 5,720 | 88% |

| 105 | 96 | SWBC MORTGAGE CORPORATION | $1.5 | 6,503 | 84% |

| 106 | 103 | EMBRACE HOME LOANS, INC. | $1.5 | 6,206 | 66% |

| 107 | 83 | MORTGAGE INVESTORS GROUP, INC. | $1.5 | 7,968 | 88% |

| 108 | 98 | AMERIS BANK | $1.5 | 6,443 | 86% |

| 109 | 132 | FIRST TECHNOLOGY | $1.5 | 2,909 | 82% |

| 110 | 111 | J.G. WENTWORTH HOME LENDING, LLC | $1.5 | 5,530 | 40% |

| 111 | 94 | AMERICAN MORTGAGE & EQUITY CONSULTANTS, INC. | $1.5 | 6,580 | 85% |

| 112 | 90 | LEADERONE FINANCIAL CORPORATION | $1.5 | 7,034 | 85% |

| 113 | 143 | HSBC BANK USA, NATIONAL ASSOCIATION | $1.5 | 1,932 | 69% |

| 114 | 84 | ARVEST BANK | $1.5 | 7,897 | 68% |

| 115 | 79 | DAS ACQUISITION COMPANY, LLC | $1.5 | 8,260 | 87% |

| 116 | 112 | MB FINANCIAL BANK, NATIONAL ASSOCIATION | $1.4 | 5,484 | 67% |

| 117 | 131 | LEADER BANK, NATIONAL ASSOCIATION | $1.4 | 3,254 | 86% |

| 118 | 114 | PERL MORTGAGE, INC. | $1.4 | 5,377 | 83% |

| 119 | 123 | PARKSIDE LENDING, LLC | $1.4 | 4,084 | 65% |

| 120 | 116 | FIRST UNITED BANK AND TRUST COMPANY | $1.4 | 5,272 | 82% |

| 121 | 107 | LAND HOME FINANCIAL SERVICES, INC. | $1.4 | 6,023 | 76% |

| 122 | 120 | DRAPER AND KRAMER MORTGAGE CORP. | $1.4 | 4,771 | 80% |

| 123 | 103 | UNION SAVINGS BANK | $1.4 | 6,206 | 72% |

| 124 | 106 | MANUFACTURERS AND TRADERS TRUST COMPANY | $1.4 | 6,108 | 47% |

| 125 | 130 | AMWEST FUNDING CORP. | $1.3 | 3,259 | 60% |

| 126 | 95 | BANCORPSOUTH BANK | $1.3 | 6,543 | 72% |

| 127 | 135 | BANK OF THE WEST | $1.3 | 2,501 | 47% |

| 128 | 108 | THIRD FEDERAL SAVINGS AND LOAN ASSOCIATION OF CLEVELAND | $1.3 | 6,005 | 54% |

| 129 | 149 | CITY NATIONAL BANK | $1.3 | 944 | 50% |

| 130 | 121 | FIRST NATIONAL BANK OF PENNSYLVANIA | $1.3 | 4,238 | 67% |

| 131 | 136 | VALLEY NATIONAL BANK | $1.2 | 2,489 | 70% |

| 132 | 122 | FIRST CITIZENS BANK & TRUST COMPANY | $1.1 | 4,132 | 56% |

| 133 | 127 | BMO HARRIS BANK NATIONAL ASSOCIATION | $1.1 | 3,877 | 47% |

| 134 | 125 | PENNYMAC LOAN SERVICES, LLC | $1.1 | 3,998 | 22% |

| 135 | 119 | KEYBANK NATIONAL ASSOCIATION | $1.1 | 5,007 | 30% |

| 136 | 146 | AXOS BANK | $1.0 | 1,363 | 56% |

| 137 | 128 | CBC NATIONAL BANK | $0.9 | 3,530 | 55% |

| 138 | 133 | ETHOS LENDING LLC | $0.9 | 2,596 | 53% |

| 139 | 126 | BRIDGEVIEW BANK GROUP | $0.9 | 3,949 | 44% |

| 140 | 145 | FREMONT BANK | $0.9 | 1,636 | 48% |

| 141 | 147 | CHARLES SCHWAB BANK | $0.8 | 1,217 | 47% |

| 142 | 138 | IMPAC MORTGAGE CORP. | $0.8 | 2,284 | 28% |

| 143 | 124 | DITECH FINANCIAL LLC | $0.8 | 4,025 | 17% |

| 144 | 139 | AMERICAN FINANCING CORPORATION | $0.6 | 2,265 | 26% |

| 145 | 140 | THE MONEY SOURCE INC. | $0.6 | 2,198 | 35% |

| 146 | 134 | NATIONSTAR MORTGAGE LLC | $0.6 | 2,546 | 6% |

| 147 | 137 | LAKEVIEW LOAN SERVICING, LLC | $0.6 | 2,309 | 21% |

| 148 | 141 | AMERISAVE MORTGAGE CORPORATION | $0.5 | 2,157 | 29% |

| 149 | 148 | PARAMOUNT EQUITY MORTGAGE, LLC | $0.3 | 974 | 13% |

| 150 | 150 | NEW DAY FINANCIAL, LLC | $0.1 | 632 | 6% |

Showing 1 to 150 of 150 entries

We used the the 2018 HMDA loan level database to calculate our results. We excluded subordinate liens and commercial properties.