Here are the top FHA Mortgage Lenders in the country.

We recently released our list of the top 150 mortgage lenders in the country. We are publishing data as we build our machine learning algorithms that will automatically match home buyers and real estate agents with the best lenders.

These top 150 lenders account for two-thirds (67%) of all mortgage originations! Let’s go one step further and see how these 150 lenders rank by mortgage type.

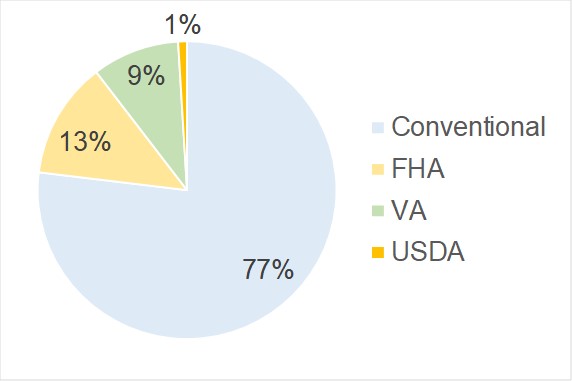

We’ll start with FHA Mortgages, which account for 16% of all mortgage originations(#) and 13% of all mortgage origination volume($) in the US. The top 150 lenders combined have similar FHA production – 16% mortgages(#) and 12% volume($).

The Super Heavyweights | $10 Billion +

Quicken and Wells Fargo were close in overall originations, but when we only look at FHA production, Quicken is in a league of their own.

| QUICKEN LOANS | $10.7B | Website |

The Heavyweights | $5-$7 Billion

While large depository banks were near the top of our overall list, they are much further down the FHA list. Loandepot.com, Caliber, and United Shore, the #1 wholesale lender, come in at 2, 3, and 4 for FHA originations. These 3 companies account for almost 9% of the FHA mortgage volume in the US.

| LOANDEPOT.COM | $6.4B | Website |

| CALIBER HOME LOANS | $5.7B | Website |

| UNITED SHORE | $5.3B | Website |

The Light Heavyweights | $3-5 Billion

This group accounts for another 11% of total FHA mortgage volume.

| FAIRWAY MORTGAGE | $4.8B | Website |

| FREEDOM MORTGAGE | $4.1B | Website |

| PACIFIC UNION (MR. COOPER) | $3.4B | Website |

| GUILD MORTGAGE COMPANY | $3.3B | Website |

| FLAGSTAR BANK | $3.0B | Website |

| HOMEBRIDGE FINANCIAL SERVICES | $3.0B | Website |

The Super Middleweights | $2-$3 Billion

Together, this group accounts for almost 9% of the total FHA mortgage market.

| FINANCE OF AMERICA | $2.7B | Website |

| CARRINGTON MORTGAGE SERVICES | $2.6B | Website |

| NEW AMERICAN FUNDING | $2.6B | Website |

| STEARNS LENDING | $2.5B | Website |

| MOVEMENT MORTGAGE | $2.4B | Website |

| GUARANTEED RATE | $2.3B | Website |

| PRIMELENDING | $2.0B | Website |

The Full List – Top FHA Mortgage Lenders

| $ FHA Rank | Mortgage Company | Volume ($Billions) | % of Originations |

|---|---|---|---|

| 1 | QUICKEN LOANS INC. | $10.69 | 13% |

| 2 | LOANDEPOT.COM, LLC | $6.42 | 21% |

| 3 | CALIBER HOME LOANS, INC. | $5.69 | 20% |

| 4 | UNITED SHORE FINANCIAL SERVICES, LLC | $5.31 | 13% |

| 5 | FAIRWAY INDEPENDENT MORTGAGE CORPORATION | $4.79 | 19% |

| 6 | FREEDOM MORTGAGE CORPORATION | $4.11 | 31% |

| 7 | PACIFIC UNION FINANCIAL, LLC | $3.44 | 57% |

| 8 | GUILD MORTGAGE COMPANY | $3.28 | 20% |

| 9 | FLAGSTAR BANK, FSB | $3.04 | 17% |

| 10 | HOMEBRIDGE FINANCIAL SERVICES, INC. | $3.00 | 27% |

| 11 | FINANCE OF AMERICA MORTGAGE LLC | $2.73 | 20% |

| 12 | CARRINGTON MORTGAGE SERVICES, LLC | $2.57 | 53% |

| 13 | BROKER SOLUTIONS, INC. | $2.57 | 27% |

| 14 | STEARNS LENDING, LLC | $2.47 | 25% |

| 15 | MOVEMENT MORTGAGE, LLC | $2.42 | 21% |

| 16 | GUARANTEED RATE, INC. | $2.34 | 11% |

| 17 | PRIMELENDING, A PLAINSCAPITAL COMPANY | $2.03 | 16% |

| 18 | PARAMOUNT RESIDENTIAL MORTGAGE GROUP, INC. | $1.98 | 38% |

| 19 | ACADEMY MORTGAGE CORPORATION | $1.94 | 23% |

| 20 | CROSSCOUNTRY MORTGAGE, INC. | $1.92 | 27% |

| 21 | NATIONSTAR MORTGAGE LLC | $1.91 | 19% |

| 22 | DHI MORTGAGE COMPANY, LTD. | $1.86 | 25% |

| 23 | EVERETT FINANCIAL, INC. | $1.62 | 23% |

| 24 | EAGLE HOME MORTGAGE, LLC | $1.60 | 18% |

| 25 | HOME POINT FINANCIAL CORPORATION | $1.46 | 23% |

| 26 | AMERICAN FINANCIAL NETWORK, INC. | $1.40 | 37% |

| 27 | CMG MORTGAGE, INC. | $1.39 | 20% |

| 28 | PRIMARY RESIDENTIAL MORTGAGE, INC. | $1.37 | 31% |

| 29 | NEWREZ LLC | $1.26 | 24% |

| 30 | PLAZA HOME MORTGAGE, INC. | $1.19 | 36% |

| 31 | CARDINAL FINANCIAL COMPANY, LIMITED PARTNERSHIP | $1.17 | 21% |

| 32 | AMERICAN PACIFIC MORTGAGE CORPORATION | $1.08 | 16% |

| 33 | AMERICAN FINANCING CORPORATION | $0.98 | 41% |

| 34 | GATEWAY MORTGAGE GROUP, LLC | $0.91 | 25% |

| 35 | RESIDENTIAL MORTGAGE SERVICES, INC. | $0.90 | 24% |

| 36 | LAKEVIEW LOAN SERVICING, LLC | $0.88 | 33% |

| 37 | NVR MORTGAGE FINANCE, INC. | $0.87 | 18% |

| 38 | FBC MORTGAGE, LLC | $0.78 | 24% |

| 39 | BAY EQUITY LLC | $0.78 | 22% |

| 40 | CORNERSTONE HOME LENDING, INC. | $0.76 | 16% |

| 41 | ENVOY MORTGAGE, LTD | $0.75 | 27% |

| 42 | THE FEDERAL SAVINGS BANK | $0.74 | 22% |

| 43 | SIERRA PACIFIC MORTGAGE COMPANY, INC. | $0.74 | 18% |

| 44 | EMBRACE HOME LOANS, INC. | $0.69 | 29% |

| 45 | AMCAP MORTGAGE, LTD. | $0.69 | 37% |

| 46 | LENDUS, LLC | $0.68 | 16% |

| 47 | DITECH FINANCIAL LLC | $0.66 | 14% |

| 48 | LAND HOME FINANCIAL SERVICES, INC. | $0.65 | 36% |

| 49 | AMERICAN NEIGHBORHOOD MORTGAGE ACCEPTANCE COMPANY LLC | $0.64 | 32% |

| 50 | CHERRY CREEK MORTGAGE CO., INC. | $0.63 | 20% |

| 51 | PENNYMAC LOAN SERVICES, LLC | $0.63 | 13% |

| 52 | SUMMIT FUNDING, INC. | $0.63 | 21% |

| 53 | UNION HOME MORTGAGE CORP. | $0.61 | 21% |

| 54 | CITYWIDE HOME LOANS, LLC | $0.61 | 21% |

| 55 | PARAMOUNT EQUITY MORTGAGE, LLC | $0.59 | 24% |

| 56 | HOMESTREET BANK | $0.58 | 10% |

| 57 | SECURITYNATIONAL MORTGAGE COMPANY | $0.57 | 29% |

| 58 | ATLANTIC BAY MORTGAGE GROUP, L.L.C. | $0.55 | 18% |

| 59 | ARK-LA-TEX FINANCIAL SERVICES, LLC. | $0.54 | 19% |

| 60 | NOVA FINANCIAL & INVESTMENT CORPORATION | $0.54 | 21% |

| 61 | US BANK NATIONAL ASSOCIATION | $0.53 | 2% |

| 62 | RUOFF MORTGAGE COMPANY, INC. | $0.50 | 26% |

| 63 | WATERSTONE MORTGAGE CORPORATION | $0.50 | 20% |

| 64 | LEADERONE FINANCIAL CORPORATION | $0.49 | 28% |

| 65 | FIRST HOME MORTGAGE CORPORATION | $0.49 | 17% |

| 66 | BANK OF ENGLAND | $0.48 | 21% |

| 67 | DAS ACQUISITION COMPANY, LLC | $0.48 | 28% |

| 68 | CITIZENS BANK, NATIONAL ASSOCIATION | $0.47 | 5% |

| 69 | FRANKLIN AMERICAN MORTGAGE COMPANY | $0.47 | 14% |

| 70 | EVERGREEN MONEYSOURCE MORTGAGE COMPANY | $0.44 | 16% |

| 71 | THE MONEY SOURCE INC. | $0.43 | 24% |

| 72 | AMERIFIRST FINANCIAL, INC. | $0.42 | 21% |

| 73 | FIRSTBANK | $0.42 | 10% |

| 74 | THE HUNTINGTON NATIONAL BANK | $0.42 | 5% |

| 75 | ON Q FINANCIAL, INC. | $0.41 | 17% |

| 76 | NAVY FEDERAL CREDIT UNION | $0.39 | 3% |

| 77 | MORTGAGE INVESTORS GROUP, INC. | $0.39 | 22% |

| 78 | TOWNE BANK | $0.38 | 18% |

| 79 | PROSPERITY HOME MORTGAGE, LLC | $0.38 | 10% |

| 80 | FIDELITY BANK | $0.37 | 14% |

| 81 | WELLS FARGO BANK, NATIONAL ASSOCIATION | $0.36 | 0% |

| 82 | J.G. WENTWORTH HOME LENDING, LLC | $0.34 | 9% |

| 83 | PULTE MORTGAGE LLC | $0.34 | 8% |

| 84 | BANK OF AMERICA, NATIONAL ASSOCIATION | $0.33 | 1% |

| 85 | AMERICAN MORTGAGE & EQUITY CONSULTANTS, INC. | $0.32 | 18% |

| 86 | JPMORGAN CHASE BANK, NATIONAL ASSOCIATION | $0.31 | 1% |

| 87 | REGIONS BANK | $0.30 | 5% |

| 88 | BARRINGTON BANK & TRUST COMPANY, N.A. | $0.29 | 9% |

| 89 | IMPAC MORTGAGE CORP. | $0.29 | 9% |

| 90 | SWBC MORTGAGE CORPORATION | $0.29 | 16% |

| 91 | MANUFACTURERS AND TRADERS TRUST COMPANY | $0.28 | 10% |

| 92 | GEORGE MASON MORTGAGE, LLC | $0.28 | 10% |

| 93 | AMERIS BANK | $0.28 | 16% |

| 94 | FIRST CHOICE LOAN SERVICES INC. | $0.27 | 11% |

| 95 | BOKF, NATIONAL ASSOCIATION | $0.27 | 9% |

| 96 | BRIDGEVIEW BANK GROUP | $0.27 | 13% |

| 97 | PARKSIDE LENDING, LLC | $0.26 | 12% |

| 98 | PERL MORTGAGE, INC. | $0.26 | 15% |

| 99 | UMPQUA BANK | $0.26 | 6% |

| 100 | PNC BANK, NATIONAL ASSOCIATION | $0.25 | 2% |

| 101 | FIFTH THIRD MORTGAGE COMPANY | $0.25 | 6% |

| 102 | MORTGAGE NETWORK, INC. | $0.24 | 13% |

| 103 | BANCORPSOUTH BANK | $0.24 | 13% |

| 104 | HOMESERVICES LENDING, LLC | $0.23 | 11% |

| 105 | CBC NATIONAL BANK | $0.23 | 13% |

| 106 | BELL BANK | $0.21 | 10% |

| 107 | TIAA, FSB | $0.21 | 3% |

| 108 | FIRST UNITED BANK AND TRUST COMPANY | $0.20 | 12% |

| 109 | AMERISAVE MORTGAGE CORPORATION | $0.20 | 11% |

| 110 | RENASANT BANK | $0.19 | 9% |

| 111 | UNLISTED | $0.18 | 8% |

| 112 | IBERIABANK | $0.18 | 6% |

| 113 | DRAPER AND KRAMER MORTGAGE CORP. | $0.17 | 10% |

| 114 | MB FINANCIAL BANK, NATIONAL ASSOCIATION | $0.17 | 8% |

| 115 | SUNTRUST BANKS, INC. | $0.16 | 2% |

| 116 | VETERANS UNITED HOME LOANS | $0.16 | 2% |

| 117 | AMWEST FUNDING CORP. | $0.13 | 6% |

| 118 | UNION SAVINGS BANK | $0.12 | 6% |

| 119 | NBKC BANK | $0.12 | 4% |

| 120 | LAKE MICHIGAN CREDIT UNION | $0.08 | 3% |

| 121 | NEW YORK COMMUNITY BANK | $0.07 | 2% |

| 122 | NEW DAY FINANCIAL, LLC | $0.07 | 3% |

| 123 | PROVIDENT FUNDING ASSOCIATES, L.P. | $0.06 | 1% |

| 124 | KEYBANK NATIONAL ASSOCIATION | $0.05 | 1% |

| 125 | BBVA USA | $0.05 | 2% |

| 126 | MUFG UNION BANK, NATIONAL ASSOCIATION | $0.05 | 1% |

| 127 | FIRST NATIONAL BANK OF PENNSYLVANIA | $0.05 | 2% |

| 128 | LEADER BANK, NATIONAL ASSOCIATION | $0.04 | 3% |

| 129 | FIRST CITIZENS BANK & TRUST COMPANY | $0.04 | 2% |

| 130 | ASSOCIATED BANK, NATIONAL ASSOCIATION | $0.04 | 1% |

| 131 | BANK OF THE WEST | $0.03 | 1% |

| 132 | TD BANK, NATIONAL ASSOCIATION | $0.02 | 0% |

| 133 | BMO HARRIS BANK NATIONAL ASSOCIATION | $0.02 | 1% |

| 134 | ZIONS BANCORPORATION, N.A. | $0.02 | 1% |

| 135 | FREMONT BANK | $0.02 | 1% |

| 136 | VALLEY NATIONAL BANK | $0.02 | 1% |

| 137 | CITIBANK, NATIONAL ASSOCIATION | $0.01 | 0% |

| 138 | AXOS BANK | $0.01 | 1% |

| 139 | BRANCH BANKING AND TRUST COMPANY | $0.01 | 0% |

| 140 | HSBC BANK USA, NATIONAL ASSOCIATION | $0.00 | 0% |

| 141 | CHARLES SCHWAB BANK | $0.00 | 0% |

| 142 | ETHOS LENDING LLC | $0.00 | 0% |

| 143 | USAA FEDERAL SAVINGS BANK | $0.00 | 0% |

| 144 | MORGAN STANLEY PRIVATE BANK, NATIONAL ASSOCIATION | $0.00 | 0% |

| 145 | UBS BANK USA | $0.00 | 0% |

| 146 | CITY NATIONAL BANK | $0.00 | 0% |

| 147 | THIRD FEDERAL SAVINGS AND LOAN ASSOCIATION OF CLEVELAND | $0.00 | 0% |

| 148 | STATE EMPLOYEES' CREDIT UNION | $0.00 | 0% |

| 149 | FIRST REPUBLIC BANK | $0.00 | 0% |

| 150 | FIRST TECHNOLOGY | $0.00 | 0% |

We used the the 2018 HMDA loan level database to calculate our results. We excluded subordinate liens and commercial properties.