I make $110,000 a year. How much house can I afford?

You can afford a $330,000 house.

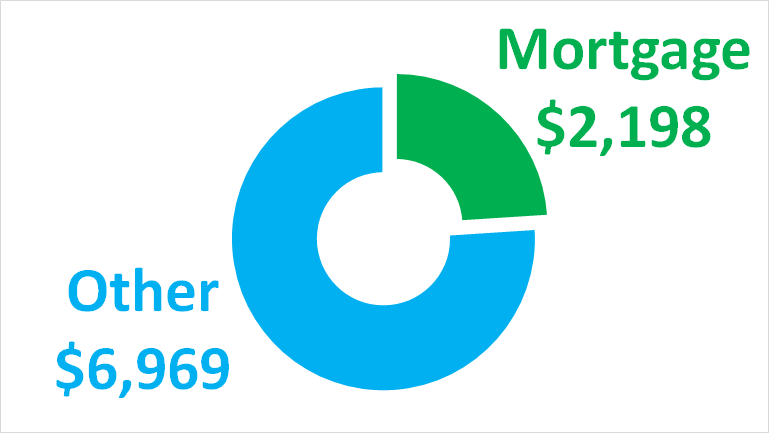

Monthly Mortgage Payment

Your mortgage payment for a $330,000 house will be $2,198. This is based on a 5% interest rate and a 10% down payment ($33,000). This includes estimated property taxes, hazard insurance, and mortgage insurance premiums.

Simple Affordability Calculator

If you want to change some assumptions, try out our how much house can I afford calculator.

We base your home price on a mortgage payment that is 24% of your monthly income. In your case, your monthly income is $9,166.

You may want to be a little more conservative or a little more aggressive. You’ll be able to change this in our how much house can I afford calculator.

Take the Quiz

Use this fun quiz to find out how much house I can afford. It only takes a few minutes and you’ll be able to review a personalized evaluation at the end.

We’ll make sure you aren’t overextending your budget. You’ll also have a comfortable amount in your bank account after you buy your home.

Don’t Overextend Your Budget

Banks and real estate agents make more money when you buy a more expensive home. Most of the time, banks will pre-approve you for the most that you can possibly afford. Right out of the gate, before you start touring homes, your budget will be stretched to the max.

It’s important to make sure that you are comfortable with your monthly payment and the amount of money you’ll have left in your bank account after you buy your home.

Compare Mortgage Rates

Make sure you compare mortgage rates before you apply for a mortgage loan. Comparing 3 lenders can save you thousands of dollars in the first few years of your mortgage. You can compare mortgage rates on Bundle

You can see current mortgage rates or see how mortgage rates today have trended over last few years on Bundle. We monitor daily mortgage rates, trends, and discount points for 15 year and 30 year mortgage products.