Who has the best mortgage rates among the largest lenders in the country?

We recently released our list of the top 150 mortgage lenders in the country.

We are publishing data as we build our machine learning algorithms that will automatically match home buyers and real estate agents with the best lenders.

Time to get to the fun stuff. Let’s see how these top lenders stack up when we compare mortgage rates.

A True Comparison

These are not advertised rates or “rate sheet” comparisons. These are actual mortgage rates over an entire year (2018).

In order to make sure we don’t have any volume mix issues, we’ll subset our data. This helps make sure we have an apples to apples comparison. Here are the main filters we used:

- Purchase

- Conventional

- 30 Year Fixed Term

- Primary Residence

- DTI <= 36

- LTV <= 80

- Loan Amount $100k-$300k

We also removed any lender who had less than 150 originated units based on these criteria. This keeps the data robust and leaves us with 121 mortgage companies.

Let’s take a look at all of the companies together.

High Level View

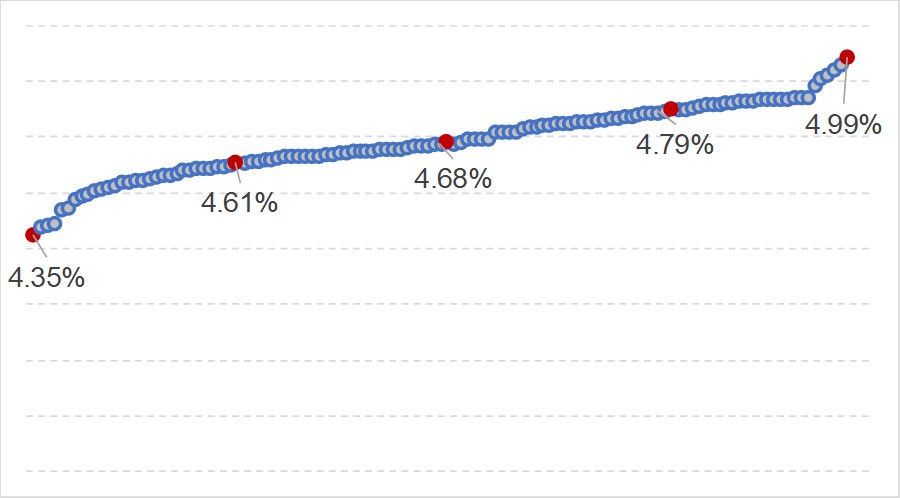

Each dot represents a company. We’ve highlighted the min (4.35%), max (4.99%), median (4.68%), 25th percentile (4.61%), and 75th percentile (4.79%).

The middle half of the mortgage companies are within a 1/4 of a percent (18bps) of one another (comparing the 25th percentile (4.61%) and the 75th percentile (4.79%)).

Points, Fees, and Lender Credits

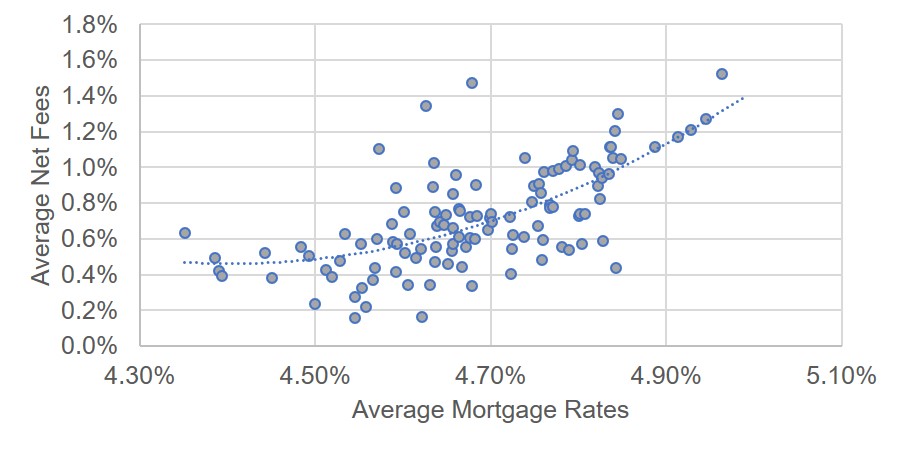

Is it possible the higher interest rate companies are offering large lender credits? Or are the low interest rate companies charging higher fees or discount points?

We took a look at this as well. Overall, the opposite is true.

Companies that charge a higher mortgage rate, generally tend to have higher fees as well. We subtracted lender credits from origination charges to get a net number and compared that to the interest.

In order to account for both the mortgage interest rate and the upfront charges, we estimated the total 5 year mortgage cost. We based our estimate on a $200,000 loan amount, the average interest rate of each company, and that company’s net origination charges (origination charges – lender credits).

The below table shows all the mortgage companies based on this 5 year estimate.

The difference in choosing a lender in the top 25 in this list versus choosing a lender in the bottom 25, is over $4,500 over 5 years on a $200,000 mortgage! In addition to the savings in costs, you’ll have paid down nearly a $1,000 more of your principal balance over that same time period.

The Full List

| Rank | Mortgage Company | Mortgage Rate | Net Origination Charges | 5-Year Estimate |

|---|---|---|---|---|

| 1 | CITIBANK, NATIONAL ASSOCIATION | 4.39% | 0.39% | $42,857 |

| 2 | LEADER BANK, NATIONAL ASSOCIATION | 4.39% | 0.42% | $42,869 |

| 3 | THIRD FEDERAL SAVINGS AND LOAN ASSOCIATION OF CLEVELAND | 4.35% | 0.63% | $42,908 |

| 4 | ETHOS LENDING LLC | 4.39% | 0.49% | $42,976 |

| 5 | PROVIDENT FUNDING ASSOCIATES, L.P. | 4.45% | 0.38% | $43,400 |

| 6 | JPMORGAN CHASE BANK, NATIONAL ASSOCIATION | 4.50% | 0.24% | $43,591 |

| 7 | BANK OF AMERICA, NATIONAL ASSOCIATION | 4.44% | 0.52% | $43,601 |

| 8 | ASSOCIATED BANK, NATIONAL ASSOCIATION | 4.55% | 0.15% | $43,878 |

| 9 | NEW YORK COMMUNITY BANK | 4.49% | 0.51% | $44,060 |

| 10 | MB FINANCIAL BANK, NATIONAL ASSOCIATION | 4.48% | 0.55% | $44,064 |

| 11 | TD BANK, NATIONAL ASSOCIATION | 4.52% | 0.39% | $44,080 |

| 12 | SUNTRUST BANKS, INC. | 4.51% | 0.42% | $44,092 |

| 13 | NBKC BANK | 4.55% | 0.27% | $44,115 |

| 14 | TIAA, FSB | 4.56% | 0.22% | $44,126 |

| 15 | BMO HARRIS BANK NATIONAL ASSOCIATION | 4.62% | -0.06% | $44,167 |

| 16 | US BANK NATIONAL ASSOCIATION | 4.55% | 0.33% | $44,299 |

| 17 | UNION SAVINGS BANK | 4.53% | 0.48% | $44,355 |

| 18 | WELLS FARGO BANK, NATIONAL ASSOCIATION | 4.57% | 0.37% | $44,508 |

| 19 | PULTE MORTGAGE LLC | 4.62% | 0.16% | $44,648 |

| 20 | LAKE MICHIGAN CREDIT UNION | 4.57% | 0.44% | $44,664 |

| 21 | FRANKLIN AMERICAN MORTGAGE COMPANY | 4.53% | 0.63% | $44,708 |

| 22 | FIRSTBANK | 4.55% | 0.57% | $44,773 |

| 23 | FIRST TECHNOLOGY | 4.61% | 0.34% | $44,850 |

| 24 | BANK OF THE WEST | 4.59% | 0.42% | $44,859 |

| 25 | FIFTH THIRD MORTGAGE COMPANY | 4.57% | 0.60% | $45,007 |

| 26 | LAND HOME FINANCIAL SERVICES, INC. | 4.74% | -0.21% | $45,079 |

| 27 | IBERIABANK | 4.63% | 0.34% | $45,102 |

| 28 | CBC NATIONAL BANK | 4.59% | 0.58% | $45,165 |

| 29 | KEYBANK NATIONAL ASSOCIATION | 4.60% | 0.52% | $45,170 |

| 30 | FIRST NATIONAL BANK OF PENNSYLVANIA | 4.59% | 0.57% | $45,175 |

| 31 | THE HUNTINGTON NATIONAL BANK | 4.62% | 0.49% | $45,247 |

| 32 | GUARANTEED RATE, INC. | 4.59% | 0.69% | $45,353 |

| 33 | BRANCH BANKING AND TRUST COMPANY | 4.62% | 0.54% | $45,390 |

| 34 | HOMESERVICES LENDING, LLC | 4.64% | 0.47% | $45,411 |

| 35 | PROSPERITY HOME MORTGAGE, LLC | 4.61% | 0.62% | $45,439 |

| 36 | PNC BANK, NATIONAL ASSOCIATION | 4.65% | 0.46% | $45,526 |

| 37 | DHI MORTGAGE COMPANY, LTD. | 4.68% | 0.34% | $45,564 |

| 38 | HOME POINT FINANCIAL CORPORATION | 4.64% | 0.55% | $45,588 |

| 39 | PLAZA HOME MORTGAGE, INC. | 4.84% | -0.46% | $45,599 |

| 40 | BELL BANK | 4.60% | 0.75% | $45,621 |

| 41 | FIRST CHOICE LOAN SERVICES INC. | 4.67% | 0.44% | $45,660 |

| 42 | BOKF, NATIONAL ASSOCIATION | 4.66% | 0.53% | $45,729 |

| 43 | NAVY FEDERAL CREDIT UNION | 4.59% | 0.89% | $45,804 |

| 44 | FREEDOM MORTGAGE CORPORATION | 4.66% | 0.57% | $45,816 |

| 45 | ARVEST BANK | 4.64% | 0.67% | $45,828 |

| 46 | FIDELITY BANK | 4.64% | 0.69% | $45,910 |

| 47 | CITIZENS BANK, NATIONAL ASSOCIATION | 4.65% | 0.68% | $45,917 |

| 48 | FIRST CITIZENS BANK & TRUST COMPANY | 4.67% | 0.55% | $45,931 |

| 49 | MANUFACTURERS AND TRADERS TRUST COMPANY | 4.66% | 0.61% | $45,958 |

| 50 | CARDINAL FINANCIAL COMPANY, LIMITED PARTNERSHIP | 4.64% | 0.75% | $45,969 |

| 51 | PERL MORTGAGE, INC. | 4.66% | 0.66% | $46,001 |

| 52 | NVR MORTGAGE FINANCE, INC. | 4.57% | 1.10% | $46,050 |

| 53 | BARRINGTON BANK & TRUST COMPANY, N.A. | 4.65% | 0.74% | $46,068 |

| 54 | MORTGAGE NETWORK, INC. | 4.68% | 0.60% | $46,070 |

| 55 | DRAPER AND KRAMER MORTGAGE CORP. | 4.68% | 0.60% | $46,117 |

| 56 | BANCORPSOUTH BANK | 4.72% | 0.40% | $46,132 |

| 57 | ZIONS BANCORPORATION, N.A. | 4.63% | 0.89% | $46,222 |

| 58 | RENASANT BANK | 4.66% | 0.76% | $46,263 |

| 59 | GEORGE MASON MORTGAGE, LLC | 4.66% | 0.77% | $46,286 |

| 60 | BRIDGEVIEW BANK GROUP | 4.68% | 0.72% | $46,308 |

| 61 | ENVOY MORTGAGE, LTD | 4.84% | -0.07% | $46,327 |

| 62 | AMERIS BANK | 4.70% | 0.65% | $46,366 |

| 63 | MORTGAGE INVESTORS GROUP, INC. | 4.66% | 0.85% | $46,383 |

| 64 | FLAGSTAR BANK, FSB | 4.68% | 0.73% | $46,396 |

| 65 | REGIONS BANK | 4.72% | 0.54% | $46,423 |

| 66 | TOWNE BANK | 4.70% | 0.69% | $46,499 |

| 67 | BBVA USA | 4.64% | 1.02% | $46,509 |

| 68 | RESIDENTIAL MORTGAGE SERVICES, INC. | 4.70% | 0.72% | $46,528 |

| 69 | LOANDEPOT.COM, LLC | 4.70% | 0.74% | $46,580 |

| 70 | PENNYMAC LOAN SERVICES, LLC | 4.73% | 0.62% | $46,586 |

| 71 | HOMESTREET BANK | 4.66% | 0.96% | $46,622 |

| 72 | FIRST UNITED BANK AND TRUST COMPANY | 4.76% | 0.48% | $46,639 |

| 73 | STEARNS LENDING, LLC | 4.74% | 0.61% | $46,698 |

| 74 | UNITED SHORE FINANCIAL SERVICES, LLC | 4.68% | 0.90% | $46,737 |

| 75 | UMPQUA BANK | 4.72% | 0.72% | $46,760 |

| 76 | FAIRWAY INDEPENDENT MORTGAGE CORPORATION | 4.76% | 0.59% | $46,874 |

| 77 | GATEWAY MORTGAGE GROUP, LLC | 4.75% | 0.67% | $46,972 |

| 78 | CHERRY CREEK MORTGAGE CO., INC. | 4.85% | 0.22% | $47,004 |

| 79 | NOVA FINANCIAL & INVESTMENT CORPORATION | 4.78% | 0.55% | $47,007 |

| 80 | USAA FEDERAL SAVINGS BANK | 4.63% | 1.34% | $47,054 |

| 81 | FBC MORTGAGE, LLC | 4.79% | 0.54% | $47,062 |

| 82 | EAGLE HOME MORTGAGE, LLC | 4.75% | 0.80% | $47,179 |

| 83 | SWBC MORTGAGE CORPORATION | 4.80% | 0.57% | $47,271 |

| 84 | FINANCE OF AMERICA MORTGAGE LLC | 4.77% | 0.77% | $47,322 |

| 85 | MOVEMENT MORTGAGE, LLC | 4.77% | 0.79% | $47,354 |

| 86 | PRIMELENDING, A PLAINSCAPITAL COMPANY | 4.77% | 0.78% | $47,357 |

| 87 | EVERETT FINANCIAL, INC. | 4.84% | 0.43% | $47,382 |

| 88 | LENDUS, LLC | 4.75% | 0.89% | $47,383 |

| 89 | CORNERSTONE HOME LENDING, INC. | 4.76% | 0.86% | $47,386 |

| 90 | CMG MORTGAGE, INC. | 4.76% | 0.90% | $47,453 |

| 91 | RUOFF MORTGAGE COMPANY, INC. | 4.83% | 0.59% | $47,543 |

| 92 | ARK-LA-TEX FINANCIAL SERVICES, LLC. | 4.80% | 0.73% | $47,548 |

| 93 | ATLANTIC BAY MORTGAGE GROUP, L.L.C. | 4.80% | 0.74% | $47,581 |

| 94 | AMERICAN MORTGAGE & EQUITY CONSULTANTS, INC. | 4.74% | 1.05% | $47,602 |

| 95 | NEWREZ LLC | 4.81% | 0.74% | $47,639 |

| 96 | GUILD MORTGAGE COMPANY | 4.76% | 0.97% | $47,649 |

| 97 | CITYWIDE HOME LOANS, LLC | 4.77% | 0.98% | $47,762 |

| 98 | QUICKEN LOANS INC. | 4.68% | 1.47% | $47,831 |

| 99 | FIRST HOME MORTGAGE CORPORATION | 4.78% | 0.99% | $47,847 |

| 100 | SIERRA PACIFIC MORTGAGE COMPANY, INC. | 4.79% | 1.01% | $47,960 |

| 101 | CALIBER HOME LOANS, INC. | 4.82% | 0.83% | $47,985 |

| 102 | BANK OF ENGLAND | 4.82% | 0.89% | $48,099 |

| 103 | ACADEMY MORTGAGE CORPORATION | 4.79% | 1.04% | $48,100 |

| 104 | AMERICAN NEIGHBORHOOD MORTGAGE ACCEPTANCE COMPANY LLC | 4.80% | 1.02% | $48,141 |

| 105 | BAY EQUITY LLC | 4.79% | 1.09% | $48,209 |

| 106 | LEADERONE FINANCIAL CORPORATION | 4.83% | 0.94% | $48,239 |

| 107 | BROKER SOLUTIONS, INC. | 4.82% | 0.97% | $48,265 |

| 108 | CROSSCOUNTRY MORTGAGE, INC. | 4.82% | 1.00% | $48,284 |

| 109 | THE FEDERAL SAVINGS BANK | 4.83% | 0.96% | $48,357 |

| 110 | AMERICAN FINANCIAL NETWORK, INC. | 4.99% | 0.22% | $48,403 |

| 111 | WATERSTONE MORTGAGE CORPORATION | 4.84% | 1.05% | $48,588 |

| 112 | UNION HOME MORTGAGE CORP. | 4.85% | 1.05% | $48,668 |

| 113 | AMERICAN PACIFIC MORTGAGE CORPORATION | 4.84% | 1.12% | $48,682 |

| 114 | PRIMARY RESIDENTIAL MORTGAGE, INC. | 4.84% | 1.11% | $48,682 |

| 115 | EVERGREEN MONEYSOURCE MORTGAGE COMPANY | 4.84% | 1.20% | $48,906 |

| 116 | AMCAP MORTGAGE, LTD. | 4.84% | 1.30% | $49,134 |

| 117 | AMERIFIRST FINANCIAL, INC. | 4.89% | 1.11% | $49,188 |

| 118 | SUMMIT FUNDING, INC. | 4.91% | 1.17% | $49,566 |

| 119 | PARAMOUNT RESIDENTIAL MORTGAGE GROUP, INC. | 4.93% | 1.21% | $49,779 |

| 120 | NATIONSTAR MORTGAGE LLC | 4.95% | 1.27% | $50,077 |

| 121 | SECURITYNATIONAL MORTGAGE COMPANY | 4.96% | 1.52% | $50,763 |